Paradigm's Brendan Malone argues that stablecoins cannot be compared to bank deposits or money market funds in terms of risk.

Stablecoins cannot be compared to bank deposits in terms of risk, argues a new policy paper authored by former Federal Reserve Board analyst Brendan Malone on behalf of technology investment firm Paradigm.the risks stablecoins pose to the financial system, noting that current legislative proposals in the United States could incorporate crypto payment instruments into existing banking and securities frameworks.

Stablecoins are cryptocurrencies programmed to have a stable value relative to a specific asset, generally a fiat currency like the U.S. dollar. A money market fund is a type of mutual fund that invests in short-term assets, cash and cash equivalents with a lower level of risk than other mutual funds.

According to Malone, banks are exposed to so-called maturity transformation when they accept short-term deposits and use those funds to offer long-term loans that are not repaid for years. The maturity transformation creates a continuous risk for banks and requires permanent risk management. A recent example of risks associated with maturity transformation is the collapse of Silicon Valley Bank in March. The U.S. bank reportedly had client deposits allocated to long-term assets andIn Malone’s view, stablecoins pegged to a fiat currency do not inherently pose similar risks because their reserve assets are usually backed by short-dated Treasurys and segregated from the issuer’s assets. “Federal regulation implemented under new legislation can require specific safeguards.

“Regulatory guardrails can help preserve confidence in stablecoins as a form of money — and ensure that the power to dictate our system of money does not fall into the hands of a few market participants,” reads the document, adding that stablecoin legislation should address the technology’s specific risks while still allowing innovation.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Crypto Firm Flashbots Raises $60M in Paradigm-Led RoundMEV-focused crypto firm flashbotsmev has raised $60 million in a new funding round led by paradigm, a company spokesperson confirmed. BrandyBetz reports

Crypto Firm Flashbots Raises $60M in Paradigm-Led RoundMEV-focused crypto firm flashbotsmev has raised $60 million in a new funding round led by paradigm, a company spokesperson confirmed. BrandyBetz reports

Read more »

Ripple Unleashes Power of Stablecoins in Bold ExperimentRipple, the San Francisco-based blockchain company, is joining forces with the Republic of Palau to pilot a U.S. Dollar-backed stablecoin

Ripple Unleashes Power of Stablecoins in Bold ExperimentRipple, the San Francisco-based blockchain company, is joining forces with the Republic of Palau to pilot a U.S. Dollar-backed stablecoin

Read more »

Sean Payton wants simplified NFL betting policy: ‘Wherever you can’t carry a gun’Sean Payton is fed up with the NFL’s gambling policies.

Sean Payton wants simplified NFL betting policy: ‘Wherever you can’t carry a gun’Sean Payton is fed up with the NFL’s gambling policies.

Read more »

Asian stocks dip before the Fed, Australia rallies on soft inflation By Investing.com⚠️BREAKING: *ASIAN STOCKS END MIXED ACROSS THE REGION AHEAD OF FED RATE DECISION; CHINA SHARES SLUMP 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asian stocks dip before the Fed, Australia rallies on soft inflation By Investing.com⚠️BREAKING: *ASIAN STOCKS END MIXED ACROSS THE REGION AHEAD OF FED RATE DECISION; CHINA SHARES SLUMP 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Read more »

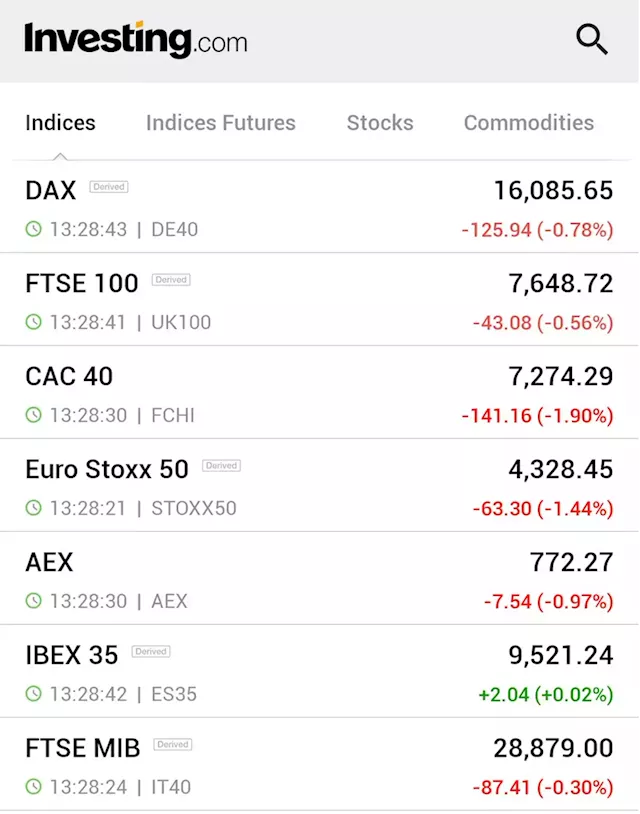

European stocks lower; LVMH weighs ahead of Fed rate decision By Investing.com⚠️BREAKING: *EUROPEAN SHARES SINK ACROSS THE CONTINENT; FRANCE'S CAC 40 DOWN ALMOST 2% 🇪🇺🇩🇪🇫🇷🇮🇹🇳🇱🇪🇸

European stocks lower; LVMH weighs ahead of Fed rate decision By Investing.com⚠️BREAKING: *EUROPEAN SHARES SINK ACROSS THE CONTINENT; FRANCE'S CAC 40 DOWN ALMOST 2% 🇪🇺🇩🇪🇫🇷🇮🇹🇳🇱🇪🇸

Read more »