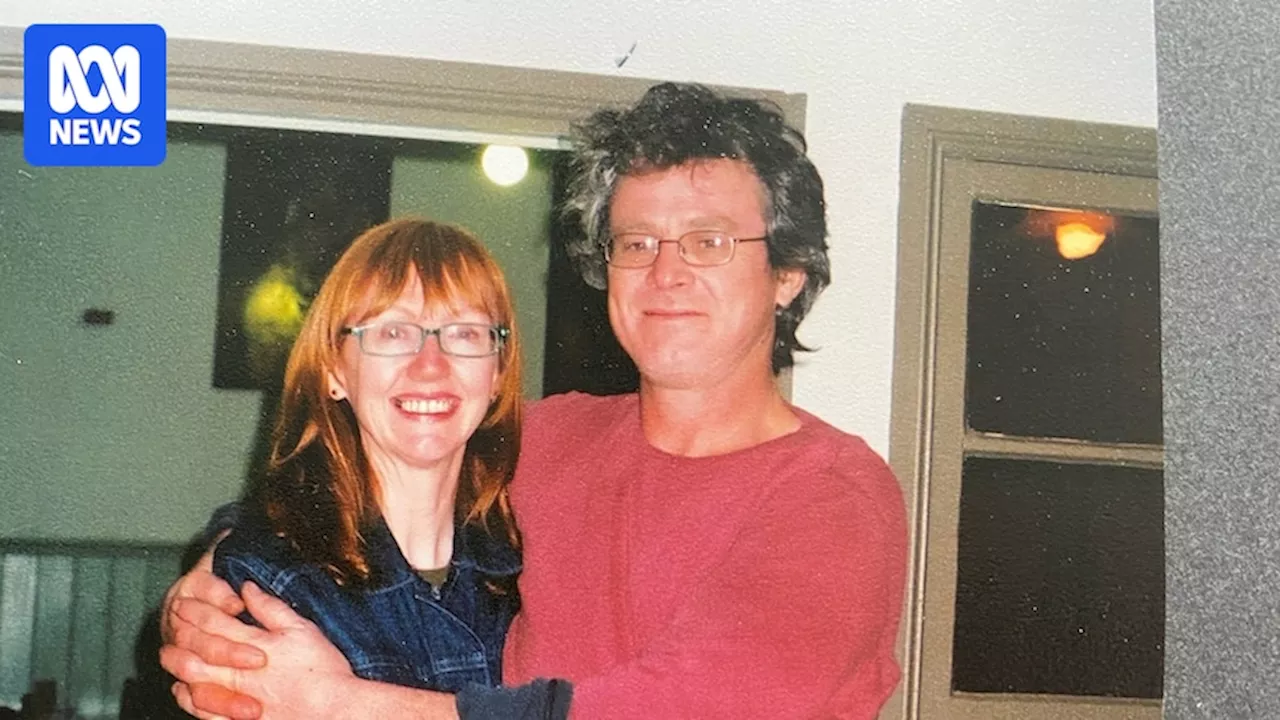

Just 18 days before Russell Wayne Hirst died of a cardiac event in November 2021, superannuation giant Cbus cancelled his insurance policy, leaving the beneficiary of his account in a year-long fight to have her claim approved.

A woman says superannuation giant Cbus took so long processing her claim that she gave up fighting for death benefit s after the death of her former partner. Assistant Treasurer Stephen Jones has told ABC News the behaviour is unacceptable and he is considering legislating mandatory timeframes in which super fund s need to respond to claims.Just 18 days before Russell Wayne Hirst died of a cardiac event in November 2021, Cbus cancelled his insurance policy.

"They haven't got any acknowledgement that that person's actually received that correspondence or even read that correspondence," Ms Ferrari-Hirst said. "We apologise unreservedly to Ms Ferrari-Hirst for any distress we have caused," a spokesperson said in a statement.Ms Ferrari-Hirst's case comes as Australia's $4 trillion superannuation industry faces a crackdown from corporate watchdog ASIC after damaging allegations about Cbus.

Ms Ferrari-Hirst's says she spent about one year fighting Cbus, and people assisting her during the claims process put in a complaint to Liberal senator Andrew Bragg's office on her behalf. Ms Ferrari-Hirst says that during the period she was trying to access the insurance benefits, Cbus lost her paperwork, which had been certified and sent by registered post.

"We do sincerely apologise for any shortcomings in the communications, or confusion arising from the communications," the spokesperson added. He says that unlike many other financial services, such as banks and insurers, super funds do not have to adhere to a mandatory code of practice or code of conduct.That means there are no enforceable minimum timeframes in which super funds must respond to members and their beneficiaries who make disability and death claims.

"These insurance benefits, they're super important. They're a huge source of income for people who have lost a loved one. "And I think there should also be clear processes for the exchange of materials, where you have competing people claiming for the same benefits." "What we're calling for is mandatory minimum standards on super funds so that consumers have timeframes for these claims to be handled," he said.He says it is up to the sector to come up with a code and adhere to it.

Superannuation Super Super Fund Insurance Life Insurance Death Benefit Covid ASIC Superannuation Funds Death Disability Insurance Claims Enforceable Code Minimum Standards Consumer Rights Mandatory Timeframes Assistant Treasurer Stephen Jones Joe Longo Financial Advice Financial Advice Reforms Business Business News Finance Finance News Auspol Australia News

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The Cbus superannuation scandalSarah Ferguson presents Australia's premier daily current affairs program, delivering agenda-setting public affairs journalism and interviews that hold the powerful to account. Plus political analysis from Laura Tingle.

The Cbus superannuation scandalSarah Ferguson presents Australia's premier daily current affairs program, delivering agenda-setting public affairs journalism and interviews that hold the powerful to account. Plus political analysis from Laura Tingle.

Read more »

Jobs go as troubled industry super giant Cbus rolls out restructureStreet Talk asked Cbus how many roles reported to chief investment officer Brett Chatfield now versus his appointment in June 2023 but did not receive a response.

Jobs go as troubled industry super giant Cbus rolls out restructureStreet Talk asked Cbus how many roles reported to chief investment officer Brett Chatfield now versus his appointment in June 2023 but did not receive a response.

Read more »

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Read more »

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Read more »

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Cbus blames administrator for ‘unacceptable’ insurance claim delaysCbus chief executive Kristian Fok apologised to the 10,000 Cbus members – as well as their families – whose death and disability claims were delayed.

Read more »

Senate probes ‘secret lobbying’ involving Treasurer Jim Chalmers and CbusChair of Economics References Committee Andrew Bragg has probed Treasurer Jim Chalmers’ decision to file a public interest immunity claim which attempted to block the release of documents detailing Cbus communications with his office.

Senate probes ‘secret lobbying’ involving Treasurer Jim Chalmers and CbusChair of Economics References Committee Andrew Bragg has probed Treasurer Jim Chalmers’ decision to file a public interest immunity claim which attempted to block the release of documents detailing Cbus communications with his office.

Read more »