This was poised to be a pivotal year for climate tech. But then, one of the major funders of climate tech collapsed.

This was poised to be a pivotal year for climate tech. After weathering a difficult political environment under the Trump administration, a global pandemic that upended the world’s supply chain, a bout of layoffs and the crash of crypto, many companies were looking to both the venture capital world and the federal government’s Inflation Reduction Act to shore up their missions to help save the planet from catastrophic warming.

The backsliding, combined with rising interest rates, has also sparked anxiety in the climate tech space with mounting concerns that it will be much harder to secure much-needed private and federal dollars, which will ultimately slow progress. This week, The Examiner sat down with Dawn Lippert, founder and CEO of Elemental Excelerator, a climate-tech incubator and nonprofit investor in projects and companies focused on climate solutions to better understand the near- and long-term impacts of the bank’s fallout. Lippert’s company supports 150 founders and companies across every part of the climate-tech ecosystem.You started Elemental Excelerator in 2009.

Report: Warriors sign Anthony Lamb to full-time contract after two-way deal ends The 25-year-old recently hit the 50-game limit of a two-way contract he signed in October Silicon Valley Bank was a major funder of climate tech start-ups. What has been the reaction to its recent collapse, and how are you seeing those impacts play out in your own portfolio of companies that you support? We’re already hearing from our portfolio companies that it’ll be harder to get debt for startups from larger banks. Many other lenders they’ve been talking to in the past wouldn’t lend or put forward a term sheet for something.

Speaking of investing in communities, your company just announced $43 million to accelerate start-ups. Can you talk about why you chose to do this now? Is this funding at risk at all, given the banking crisis? This is a really key moment to be leaning into our sector. Every year we invest in a cohort of companies, and this year, largely in response to what happened at SBV, we actually doubled down and are doing more and doing it faster.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Anxiety Strikes $8 Trillion Mortgage-Debt Market After SVB CollapseNow that the FDIC has taken over SVB, investors expect mortgage-backed securities to be sold off, pushing prices lower

Anxiety Strikes $8 Trillion Mortgage-Debt Market After SVB CollapseNow that the FDIC has taken over SVB, investors expect mortgage-backed securities to be sold off, pushing prices lower

Read more »

SVB contagion: Australia reportedly asks banks to report on cryptoThe Australian Prudential Regulation Authority has reportedly asked banks to report daily crypto transactions amid the ongoing global banking crisis.

SVB contagion: Australia reportedly asks banks to report on cryptoThe Australian Prudential Regulation Authority has reportedly asked banks to report daily crypto transactions amid the ongoing global banking crisis.

Read more »

Yellen defends government intervention to avoid another SVBAccording to the Treasury Secretary, the intervention was also aimed at preserving the “important role” of small to mid-size lenders in the U.S economy.

Yellen defends government intervention to avoid another SVBAccording to the Treasury Secretary, the intervention was also aimed at preserving the “important role” of small to mid-size lenders in the U.S economy.

Read more »

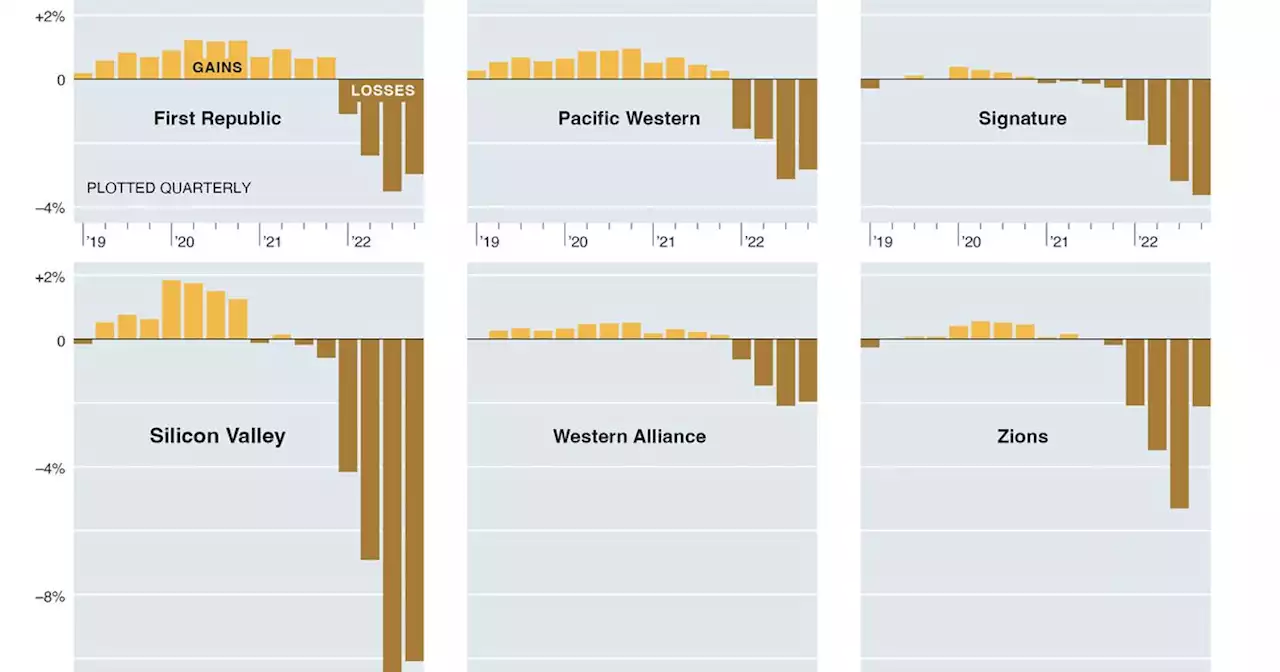

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

Read more »

SVB's implosion leads founders to reevaluate VC relationshipsThe SVB fallout has been a wake up call for startup founders. Many are rethinking their VC relationships: 'There's certain people I wouldn't want to take money from now.'

Read more »

SVB Financial Group accuses FDIC of cutting it off from cashSVB Financial Group said on Tuesday the U.S. Federal Deposit Insurance Corporation had taken 'improper actions' to cut it off from cash held at its former subsidiary Silicon Valley Bank, which was seized by regulators to stem a national bank run.

SVB Financial Group accuses FDIC of cutting it off from cashSVB Financial Group said on Tuesday the U.S. Federal Deposit Insurance Corporation had taken 'improper actions' to cut it off from cash held at its former subsidiary Silicon Valley Bank, which was seized by regulators to stem a national bank run.

Read more »