Secretive hedge fund Tiger Global changed the rules on tech investing. Then it all went bad. mcelarier reports

Tiger Global founder Chase Coleman III is a New York blue blood who made $10 billion with an aggressive, controversial investment style. The past six months have not been good to him. Photo-Illustration: Intelligencer. Photo: Amanda L. Gordon/Bloomberg This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

The meltdown at Coleman’s firm, named Tiger Global in a nod to his mentor, is one for the ages. “Their losses look to be the biggest in the history of hedge funds,” says one hedge-fund manager, ticking off other notable contenders for that unfortunate title.

Chase Coleman’s wife, Stephanie Ercklentz, starred in the 2003 documentary Born Rich along with Ivanka Trump. Photo: Amanda L. Gordon/Bloomberg via Getty Images Whatever initial misgivings early investors may have had about Coleman, over the next two decades, he put up double-digit returns annually and became heralded as a wunderkind.

This year, Tiger Global’s hedge fund fell an astonishing 52 percent through May, according to an investor letter – much more than the overall market or the tech-heavy Nasdaq . Its long-only fund has fallen even more — some 60 percent this year. That means Tiger Global has lost about three-quarters of the gains made for investors since launching the hedge fund in 2001, according to calculations from data provided by Rick Sopher, chairman of LCH Investments in London.

Based on current numbers alone, Tiger Global’s losses appear to exceed recent ones at its much-larger Japanese rival, Softbank Vision Fund, which drew mainstream attention for pumping billions of dollars into WeWork before the real estate–slash–lifestyle company blew up in a massive scandal in 2019. At the end of March, Softbank Vision had lost $20 billion over the past year.

The young hedge-fund manager’s key hire turned out to be Scott Shleifer, who had spent the prior three years at the Blackstone Group, the heavyweight private-equity firm. The two men had opposite temperaments — Shleifer is hard-charging and outgoing — and came from different worlds. As Shleifer explained to Mallaby, “My father sold couches for a living.”

“Tiger could be a little bit more aggressive. They could move quicker. They paid higher prices than a lot of their venture peers,” says hedge-fund consultant Greg Dowling of Fund Evaluation Group. “And that worked really well until everybody else started following the same strategy. They got bigger, which means you had to put more money out. Prices got higher. And so at some point, it stopped working.

“Ask 10 VCs for their thoughts on Tiger et al., and most of them will react with a mix of dismissiveness and disgust.

There is little doubt, however, that Tiger Global wanted to do a lot of deals as quickly as possible. In its 2020 anniversary letter, the firm said it was “searching for ways to make our investment flywheel spin faster.” Now it seems to have spun out of control. Recent crash aside, Tiger Global definitely profited from its Peloton investment ; but the bigger question is whether the firm’s larger model still works. “The issue is that a lot of these companies existed to grow the revenues and ignore profitability,” says Harris Kupperman, the founder of hedge fund Praetorian Capital, who argues that these companies enriched the owners and early investors and left later investors with massive losses.

“The Tiger-40 is a list of the most over-owned hedge fund hotels I can think of,” Kupperman wrote on his blog, Adventures in Capitalism, in January. “Most of the large portfolio managers all know each other. They share the same notes. They copy each other and they copy what’s been working.” Indeed, a number of other Tiger cubs show up in these crowded trades — names including Coatue Management, Lone Pine Capital, Maverick Capital, Viking Global Investors, and D1 Capital Partners.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

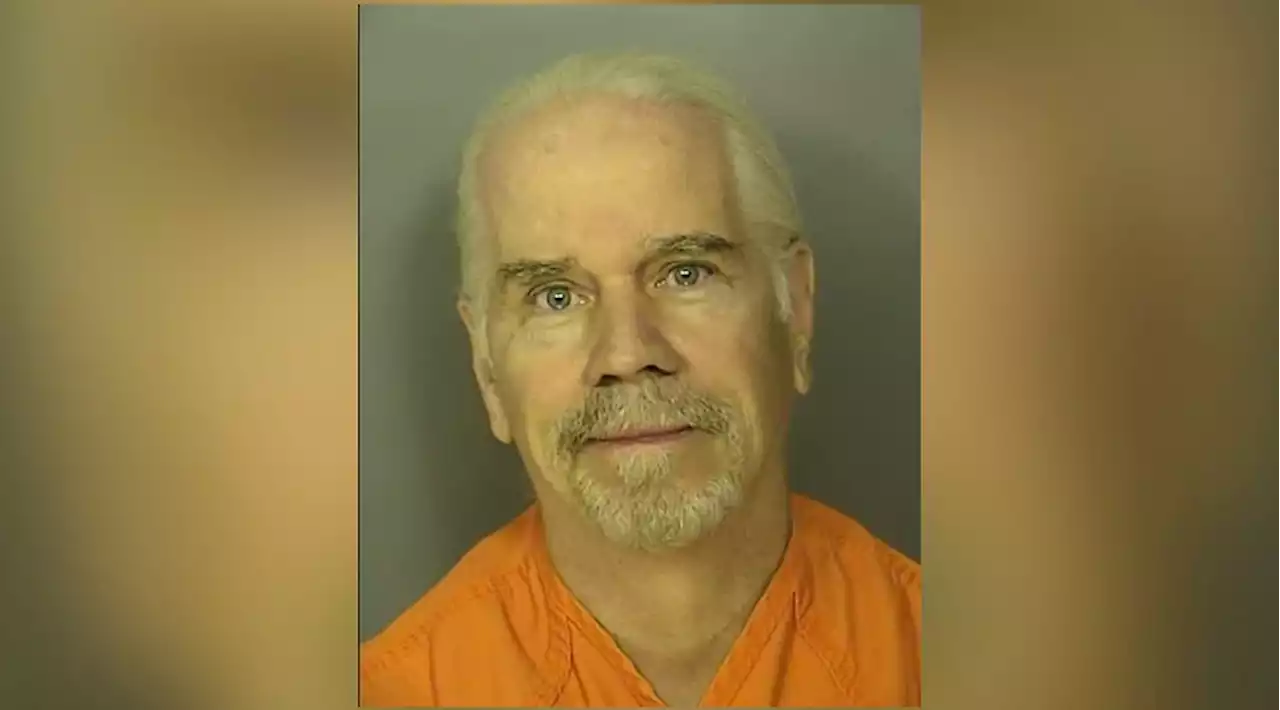

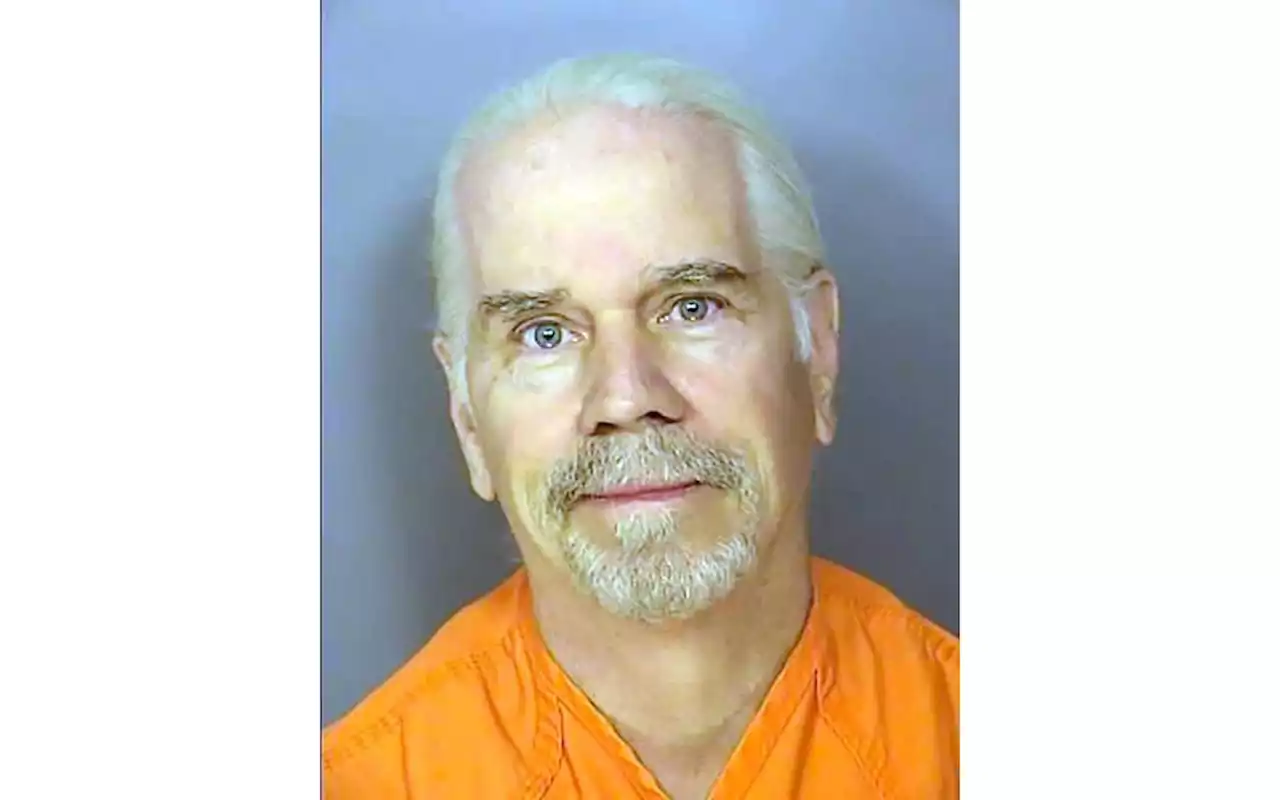

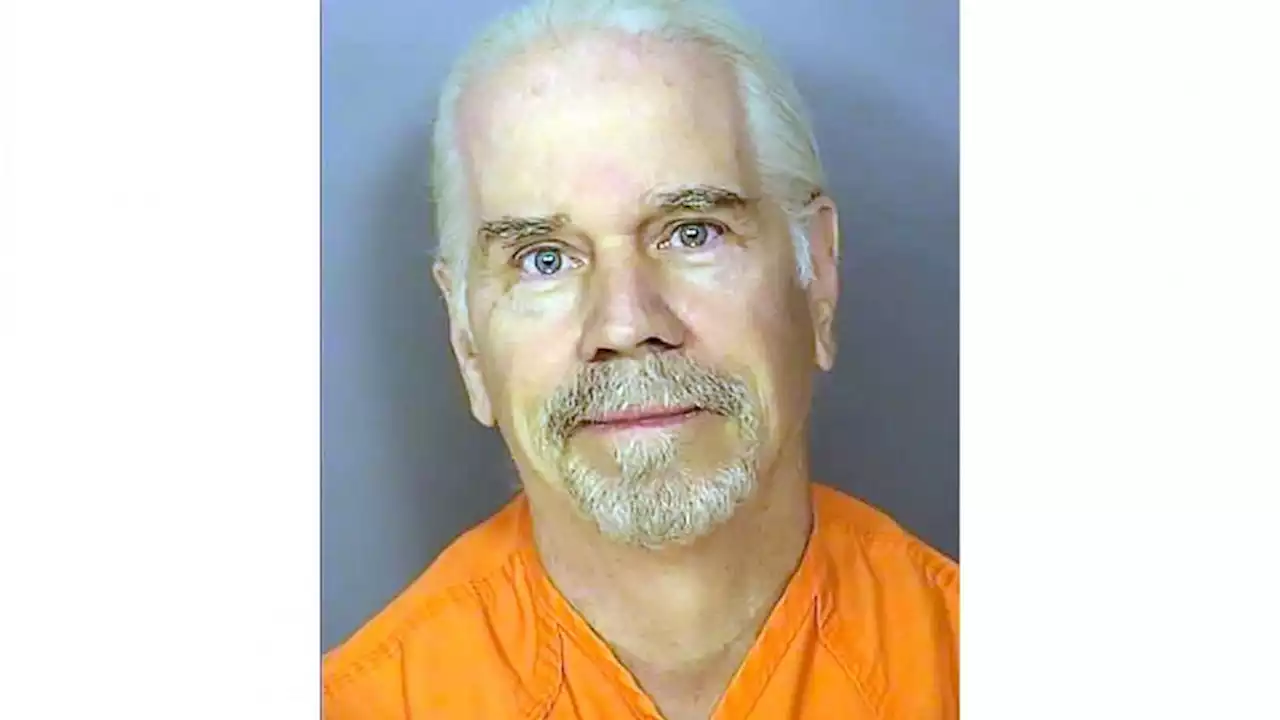

Prosecutors: ‘Tiger King’ star trafficked endangered animalsThe U.S. Endangered Species Act requires permission to buy or move any endangered species in captivity and prosecutors said Antle, two of his employees and owners of safari tours in Texas and California all broke the law.

Prosecutors: ‘Tiger King’ star trafficked endangered animalsThe U.S. Endangered Species Act requires permission to buy or move any endangered species in captivity and prosecutors said Antle, two of his employees and owners of safari tours in Texas and California all broke the law.

Read more »

‘Tiger King’ star trafficked endangered animals, prosecutors say'Tiger King' star Bhagavan 'Doc' Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork, federal prosecutors in South Carolina said Thursday.

‘Tiger King’ star trafficked endangered animals, prosecutors say'Tiger King' star Bhagavan 'Doc' Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork, federal prosecutors in South Carolina said Thursday.

Read more »

Walking Dead: Ezekiel's Tiger Is the Perfect Metaphor for Rick's JourneyKing Ezekiel and Rick Grimes mirror each other in how they maintain power. Both use symbols of authority from before the outbreak to lead, despite doubting their own credentials, knowing one failure could get them eaten alive. TheWalkingDead

Walking Dead: Ezekiel's Tiger Is the Perfect Metaphor for Rick's JourneyKing Ezekiel and Rick Grimes mirror each other in how they maintain power. Both use symbols of authority from before the outbreak to lead, despite doubting their own credentials, knowing one failure could get them eaten alive. TheWalkingDead

Read more »

Prosecutors: ‘Tiger King’ star and Monterey County ranch operator trafficked endangered animals“Tiger King” star Bhagavan “Doc” Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork, federal prosecutor…

Prosecutors: ‘Tiger King’ star and Monterey County ranch operator trafficked endangered animals“Tiger King” star Bhagavan “Doc” Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork, federal prosecutor…

Read more »

Prosecutors: 'Tiger King' star trafficked endangered animalsFederal prosecutors in South Carolina say “Tiger King” star Bhagavan “Doc” Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork

Prosecutors: 'Tiger King' star trafficked endangered animalsFederal prosecutors in South Carolina say “Tiger King” star Bhagavan “Doc” Antle has been charged with buying or selling endangered lemurs, cheetahs, and a chimpanzee without the proper paperwork

Read more »

Tiger at Columbus Zoo dies from COVID-19 complications, zoo saysJupiter had been on long-term treatment for chronic underlying illnesses, making him more susceptible to catching COVID-19 and suffering complications.

Tiger at Columbus Zoo dies from COVID-19 complications, zoo saysJupiter had been on long-term treatment for chronic underlying illnesses, making him more susceptible to catching COVID-19 and suffering complications.

Read more »