Analysis: the chancellor has a set of options for making the tax system fairer at the same time as bringing in revenue

Third, he could introduce an annual wealth tax of 1.1% on individual wealth above £10m, after netting off mortgages and other debts. This. For this group the usual economic arguments against a wealth tax, for example that it discourages savings, do not apply.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

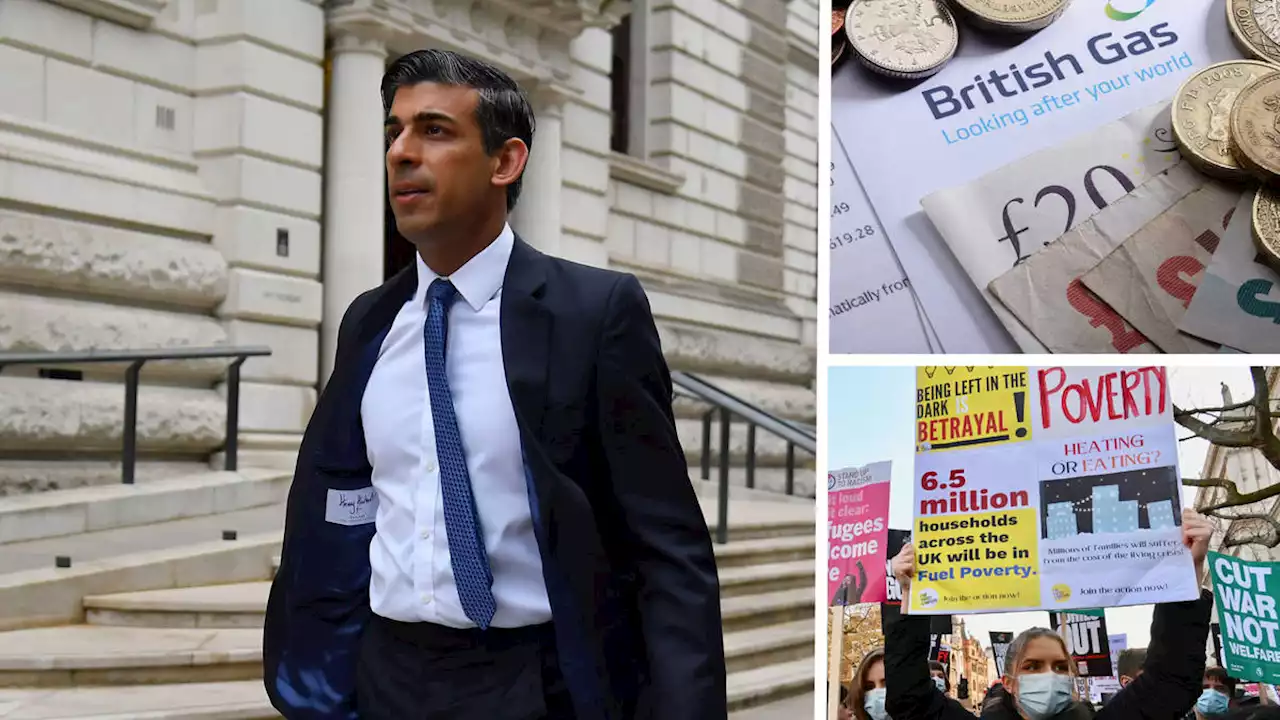

Is government IT preventing Rishi Sunak from paying more to poorer Britons?Britain’s chancellor was right on one count: the government IT systems that control welfare payments are a constraint. But he was wrong on another: it is not an excuse for inaction

Is government IT preventing Rishi Sunak from paying more to poorer Britons?Britain’s chancellor was right on one count: the government IT systems that control welfare payments are a constraint. But he was wrong on another: it is not an excuse for inaction

Read more »

Sunak considering £600 payment to help poorer families heat homesChancellor under pressure to act on cost of living crisis

Sunak considering £600 payment to help poorer families heat homesChancellor under pressure to act on cost of living crisis

Read more »

Sunak considering £600 payment to help poorer families heat homesChancellor under pressure to act on cost of living crisis

Sunak considering £600 payment to help poorer families heat homesChancellor under pressure to act on cost of living crisis

Read more »

Sunak 'planning energy bill discount and tax cut' as Brits grapple with cost of livingChancellor Rishi Sunak is reportedly planning to increase the warm home discount before cutting taxes in the autumn to help struggling Brits cope with the cost of living crisis.

Sunak 'planning energy bill discount and tax cut' as Brits grapple with cost of livingChancellor Rishi Sunak is reportedly planning to increase the warm home discount before cutting taxes in the autumn to help struggling Brits cope with the cost of living crisis.

Read more »

Rishi Sunak Promises Tax Cut For Business – But Only 'Stands Ready' To Help FamiliesChancellor under pressure to take urgent action on the cost-of-living crisis as official figures showed inflation soaring to a 40-year high.

Rishi Sunak Promises Tax Cut For Business – But Only 'Stands Ready' To Help FamiliesChancellor under pressure to take urgent action on the cost-of-living crisis as official figures showed inflation soaring to a 40-year high.

Read more »