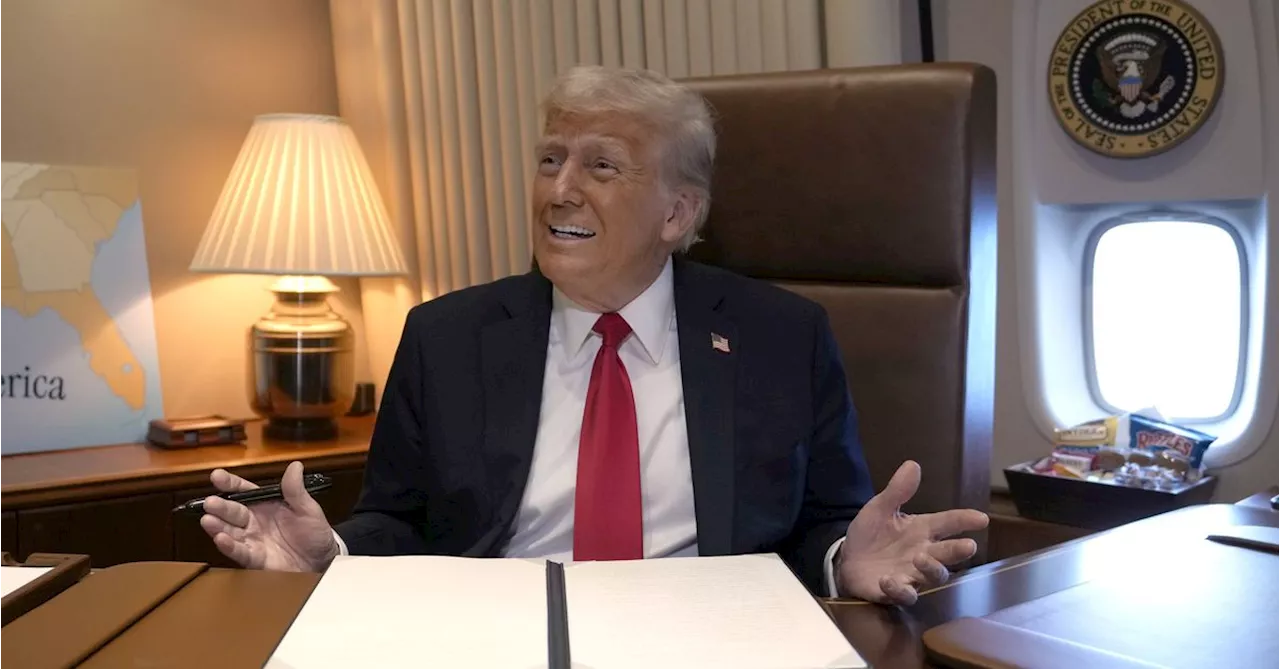

President Trump's announcement of 25% tariffs on steel and aluminum imports from all countries has sparked a wave of uncertainty in global trade. His plans to implement reciprocal tariffs against unfair trading practices by other nations, particularly China and the EU, have raised concerns about a potential trade war. While Australia is likely to seek exemption, the lack of certainty surrounding Trump's decisions has created a volatile trading environment.

Trump announced plans to impose 25 percent tariffs on steel and aluminum imports from all countries, signaling a significant shift in trade policy. While he didn't specify a date for implementation, he stated that he would unveil new reciprocal tariffs later this week. These announcements coincided with China's retaliatory tariffs on US goods, which went into effect following Trump 's 10 percent duty on all Chinese exports to the US.

This latest move by Trump contrasts with his previous tariff policies, which exempted close trading partners like Australia. Australia, with over $1 billion in steel and aluminum exports exposed to these new tariffs, is likely to seek exemptions from Trump, highlighting its trade surplus with the US, strong defense alliance, and capacity to supply strategic minerals.However, there is no guarantee that Trump will grant exemptions this time, unlike his previous approach where he exempted countries like Mexico and Canada after they made concessions on border security and fentanyl trafficking. In 2018, Trump's tariffs primarily targeted China and Europe, but this time, he intends to wield them as a multi-purpose tool. These tools include retaliating against perceived unfair trading practices by countries like China and those in the European Union, pressuring Canada and Mexico to curb illegal immigration, and leveraging them to compel or attract industries to invest in the US to avoid the tariffs. Trump also aims to use tariffs as a significant revenue source for the US government, potentially funding his tax cuts for corporations and wealthy individuals.Despite his preference for reciprocal tariffs over a universal baseline tariff, Trump has flip-flopped on several trade policy decisions. His original campaign promise included a 10 to 20 percent baseline tariff on all imports and a 60 percent rate on Chinese imports. However, he has since backed away from this pledge, opting for a more targeted approach. His seemingly ad hoc tariff announcements, made before the completion of a review of US trade and economic policies, have caused widespread chaos and confusion. The US Postal Service and Customs and Border Protection haven't been equipped to handle the volume of small parcels entering the country, forcing Trump to suspend tariffs on goods worth less than $US800 from China. This demonstrates the complexity and potential unintended consequences of Trump's trade policies

Economy Trade TRUMP TARIFFS STEEL ALUMINUM TRADE WAR CHINA EUROPE AUSTRALIA GLOBAL TRADE

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trump announces 25 per cent steel and aluminium import tariff on all steel and aluminium importsAustralian iron and steel exports to the US were worth $378,803,827 in 2023.

Trump announces 25 per cent steel and aluminium import tariff on all steel and aluminium importsAustralian iron and steel exports to the US were worth $378,803,827 in 2023.

Read more »

After igniting trade war, Trump admits tariff ‘pain’ for consumers is possibleThe US president also singled out the Murdoch-owned Wall Street Journal after it called Trump’s tariffs the “the dumbest trade war in history”.

After igniting trade war, Trump admits tariff ‘pain’ for consumers is possibleThe US president also singled out the Murdoch-owned Wall Street Journal after it called Trump’s tariffs the “the dumbest trade war in history”.

Read more »

ASX Plunges on Trump Tariff Threats, Fears of Global Trade WarThe Australian stock market experienced its biggest one-day loss in five months, driven by Donald Trump's imposition of tariffs on Chinese imports and escalating global trade tensions. All sectors declined, with consumer discretionary and healthcare stocks hit hardest. The Australian dollar fell to a five-year low against the US dollar.

ASX Plunges on Trump Tariff Threats, Fears of Global Trade WarThe Australian stock market experienced its biggest one-day loss in five months, driven by Donald Trump's imposition of tariffs on Chinese imports and escalating global trade tensions. All sectors declined, with consumer discretionary and healthcare stocks hit hardest. The Australian dollar fell to a five-year low against the US dollar.

Read more »

European Stocks Rebound as Automakers Gain on Trump Tariff ReliefEuropean stock markets closed higher after an initial dip, driven by gains in automakers following signals that President-elect Trump will not implement new tariffs on his first day in office. Traders welcomed the news, easing concerns about global growth and inflation. The Stoxx Europe 600 Index rose slightly, while London's FTSE 100 reached a fresh record high.

European Stocks Rebound as Automakers Gain on Trump Tariff ReliefEuropean stock markets closed higher after an initial dip, driven by gains in automakers following signals that President-elect Trump will not implement new tariffs on his first day in office. Traders welcomed the news, easing concerns about global growth and inflation. The Stoxx Europe 600 Index rose slightly, while London's FTSE 100 reached a fresh record high.

Read more »

Australian Sharemarket Recovers After Trump's Tariff ThreatThe Australian sharemarket initially tumbled following reports that President Trump could impose tariffs on Mexico and Canada, but later recovered some losses. The S&P/ASX 200 Index closed 0.6% higher, driven by optimism surrounding positive earnings reports from Australian miners. However, Trump's threat to implement tariffs starting February 1 led to a brief market decline before it rebounded.

Australian Sharemarket Recovers After Trump's Tariff ThreatThe Australian sharemarket initially tumbled following reports that President Trump could impose tariffs on Mexico and Canada, but later recovered some losses. The S&P/ASX 200 Index closed 0.6% higher, driven by optimism surrounding positive earnings reports from Australian miners. However, Trump's threat to implement tariffs starting February 1 led to a brief market decline before it rebounded.

Read more »

Trump's Tariff Threat Sends Dollar SoaringUS President Donald Trump's suggestion of imposing 25% tariffs on imports from Mexico and Canada sparked volatility in currency markets, sending the US dollar to five-year highs against its Canadian and Mexican counterparts. Asian markets reacted with muted moves, while European markets experienced slight declines. Trump's address also raised concerns about potential trade conflicts with China and the EU.

Trump's Tariff Threat Sends Dollar SoaringUS President Donald Trump's suggestion of imposing 25% tariffs on imports from Mexico and Canada sparked volatility in currency markets, sending the US dollar to five-year highs against its Canadian and Mexican counterparts. Asian markets reacted with muted moves, while European markets experienced slight declines. Trump's address also raised concerns about potential trade conflicts with China and the EU.

Read more »