British consumer price inflation defied expectations that it would slow and held at 8.7% in May, official figures showed, a day before the Bank of England is forecast to raise interest rates for the 13th time in a row

Markets increased their bets on further rate rises following Wednesday's official figures, which also showed underlying inflation rose to its highest since 1992 last month.The numbers are uncomfortable for Prime Minister Rishi Sunak - who has pledged to halve inflation over the course of this year before a probable 2024 election - and are likely to add to the rise in mortgage costs for millions of homeowners.

Sterling briefly jumped against the U.S. dollar and the euro after the figures were released and two-year government bond yields - which are sensitive to interest rate expectations - rose to their highest since July 2008. "If you look at what's happening in other countries, you can see that rises in interest rates do bring down inflation over time, that will happen here," he added.

The Office for National Statistics said core inflation - a measure which excludes volatile food, energy, alcohol and tobacco prices, and which the BoE views as a good guide to underlying price pressures - unexpectedly rose to 7.1% from 6.8%, its highest since March 1992. Food and drink price inflation dropped slightly to 18.3% from April's 19.0%, with the biggest downward pressure from milk, cheese and eggs.

Last month the BoE forecast inflation would drop to just over 5% in the final quarter of this year and fall below its 2% target in early 2025.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

UK inflation exceeds expectations in May, piling pressure on the government and Bank of EnglandU.K. inflation came in hotter than expected in May as consumer prices rose by an annual 8.7%, unchanged from the previous month.

UK inflation exceeds expectations in May, piling pressure on the government and Bank of EnglandU.K. inflation came in hotter than expected in May as consumer prices rose by an annual 8.7%, unchanged from the previous month.

Read more »

Bank of England's conundrum deepens as inflation and labor market stay hotThe Bank of England is 'caught between a rock and a hard place' as it prepares for a key monetary policy decision.

Bank of England's conundrum deepens as inflation and labor market stay hotThe Bank of England is 'caught between a rock and a hard place' as it prepares for a key monetary policy decision.

Read more »

Breakingviews - Credibility crisis requires BoE to write new plotSince May 24, thousands of British people have had their homeowning dreams dashed by a sudden spike in mortgage rates. The immediate culprit is higher-than-expected inflation in April, which spooked markets. Underlying that, though, is the flawed way in which the Bank of England communicates future monetary policy. The inaccuracy of the forecasts and their negative impact on the real economy suggest that it’s time to take a different approach.

Breakingviews - Credibility crisis requires BoE to write new plotSince May 24, thousands of British people have had their homeowning dreams dashed by a sudden spike in mortgage rates. The immediate culprit is higher-than-expected inflation in April, which spooked markets. Underlying that, though, is the flawed way in which the Bank of England communicates future monetary policy. The inaccuracy of the forecasts and their negative impact on the real economy suggest that it’s time to take a different approach.

Read more »

2023 British Open odds: Who are the favorites to win at Royal Liverpool?FrontPageBets takes a look at the early odds for the 2023 British Open at Royal Liverpool in mid-July.

2023 British Open odds: Who are the favorites to win at Royal Liverpool?FrontPageBets takes a look at the early odds for the 2023 British Open at Royal Liverpool in mid-July.

Read more »

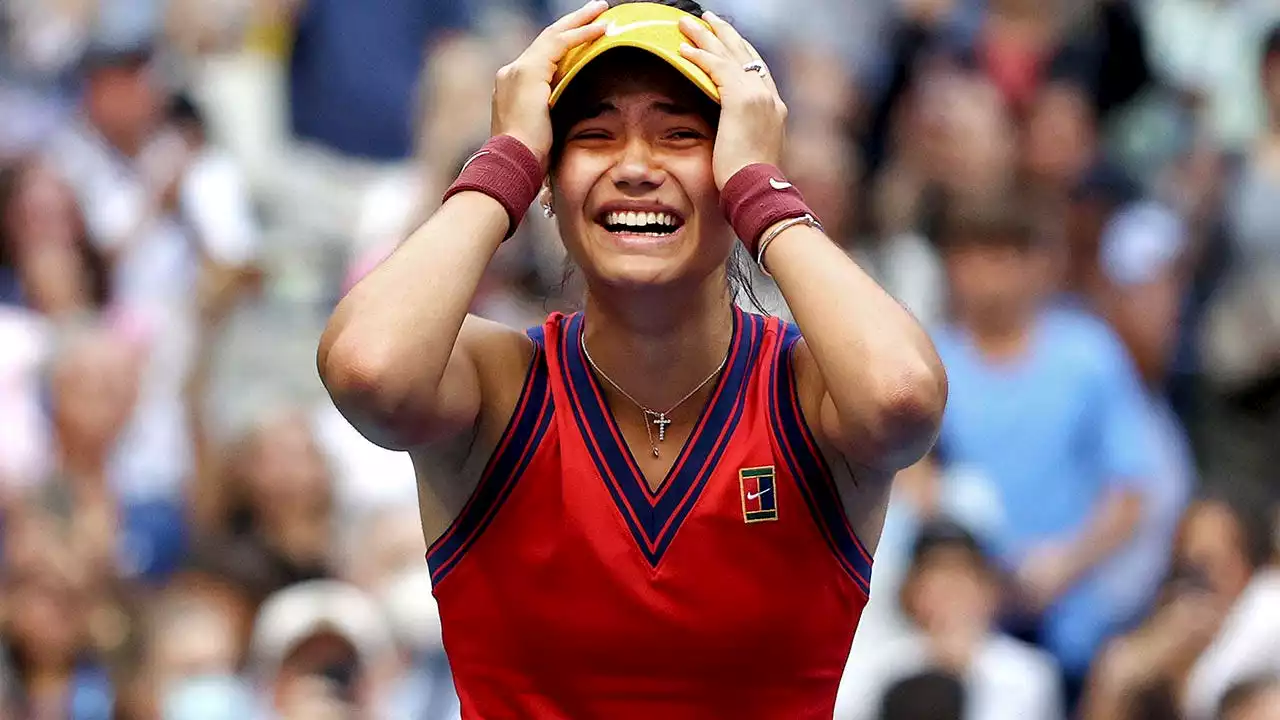

British tennis star Emma Raducanu admits she sometimes wishes she never won US OpenEmma Raducanu won the U.S. Open as an 18-year-old but with that came more expectations. On Sunday, she admitted she sometimes wishes it didn't happen.

British tennis star Emma Raducanu admits she sometimes wishes she never won US OpenEmma Raducanu won the U.S. Open as an 18-year-old but with that came more expectations. On Sunday, she admitted she sometimes wishes it didn't happen.

Read more »

British Royal Family Rolls Out For Garter Day at Windsor CastleKing Charles III celebrates his first Garter Day as Sovereign.

British Royal Family Rolls Out For Garter Day at Windsor CastleKing Charles III celebrates his first Garter Day as Sovereign.

Read more »