The UK government has provided a detailed response to its consultation on proposals for crypto asset regulation.

The UK government provided a detailed response to its consultation for crypto asset regulation, publishing on Monday final proposals that were informed by companies, experts and market events, "including the failure of FTX."

The document described how firms undertaking crypto asset activities will now have to be authorized by the UK's Financial Conduct Authority. The authorization will include a stipulation for crypto exchanges to create detailed requirements for admission standards and mandate disclosures when listing new assets.The final proposals did not cover the regulation of decentralized finance, and the report said that DeFi regulation would not be attempted in this phase of development.

The rules laid out in the final proposals document will be brought under existing UK market law, rather than exist as a standalone regulatory regime. "The consultation has proposed to apply and adapt existing frameworks for traditional finance custodians," the document added.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

10-year Treasury yield jumps as traders eye Treasury's quarterly refundingVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

10-year Treasury yield jumps as traders eye Treasury's quarterly refundingVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Read more »

Yields jump ahead of Treasury’s quarterly refunding processVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Yields jump ahead of Treasury’s quarterly refunding processVivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Read more »

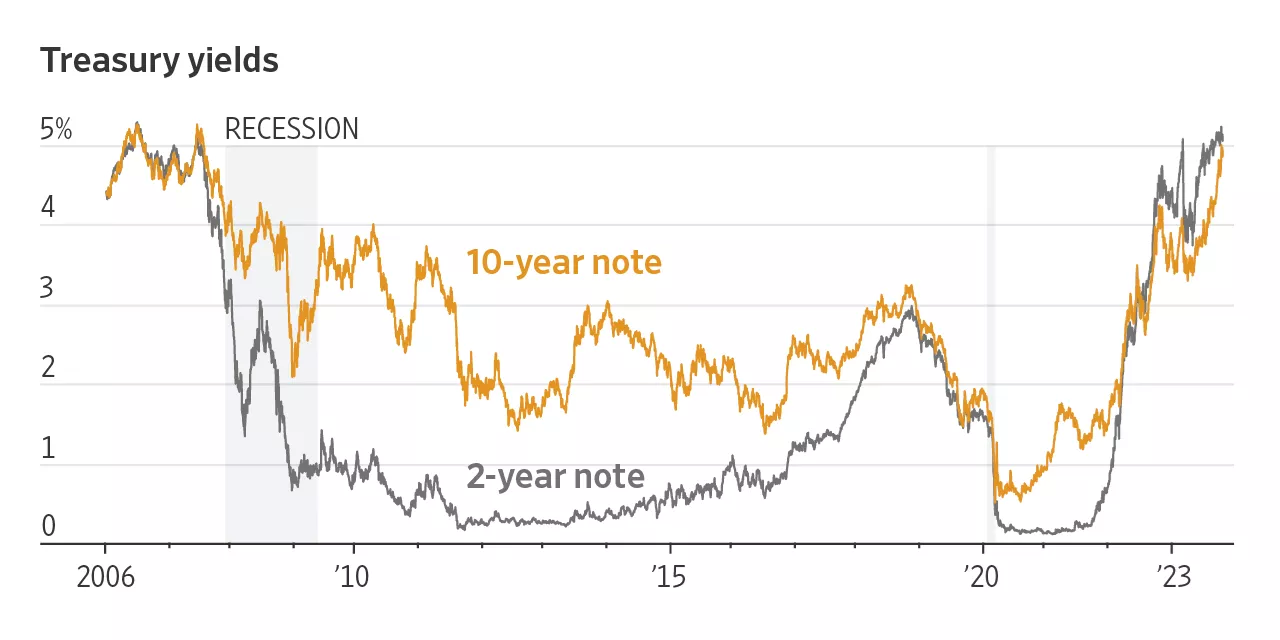

Decoding the (Almost) 5% 10-Year Treasury YieldInvestors debate whether borrowing benchmark has finally topped out

Decoding the (Almost) 5% 10-Year Treasury YieldInvestors debate whether borrowing benchmark has finally topped out

Read more »

In the Market-Treasury market braces for seismic SEC ruleIn the Market-Treasury market braces for seismic SEC rule

In the Market-Treasury market braces for seismic SEC ruleIn the Market-Treasury market braces for seismic SEC rule

Read more »

S&P 500 Forecast: Index gains on Monday as markets look ahead to Apple earnings, Treasury refundingThe S&P 500 index opened higher on Monday as the market hopes the more attractively-valued index can rally following two consecutive weeks of greater than 2% losses.

S&P 500 Forecast: Index gains on Monday as markets look ahead to Apple earnings, Treasury refundingThe S&P 500 index opened higher on Monday as the market hopes the more attractively-valued index can rally following two consecutive weeks of greater than 2% losses.

Read more »

Why Treasury's borrowing needs could overshadow the Federal Reserve decision‘We are running outsized deficits for an economy at full employment,’ said Gregory Faranello, head of U.S. rates for AmeriVet Securities in New York. ‘This has market participants concerned.’

Why Treasury's borrowing needs could overshadow the Federal Reserve decision‘We are running outsized deficits for an economy at full employment,’ said Gregory Faranello, head of U.S. rates for AmeriVet Securities in New York. ‘This has market participants concerned.’

Read more »