As climate change increases the severity and frequency of natural disasters, insurance companies face pressure to improve the handling of their claims.

Add articles to your saved list and come back to them any time.There was nothing more Rick Maloney could have done when the floods hit his home town of Mooroopna, in Victoria’s north, in October 2022.

The real battle would begin months later when Maloney lodged a claim with his insurer, AAMI, to repair the damage to his home. Between February 1, 2022 and September 30, 2023, the Australian Financial Complaints Authority received more than 45,000 general insurance complaints, a 39 per cent increase compared to the same period a year earlier.

“There seems to be a cultural problem with insurers,” she says. “Their starting position is they’re looking to decline a claim, rather than looking for ways to accept it.”As climate change increases the severity and frequency of natural disasters, the horror floods of 2022 and the intense bushfires of 2019, dubbed once-in-a-century events, will likely become more regular occurrences.

“There’s been a policy vacuum because no one’s known this is a problem,” Settle says. “Most of the people in parliament are probably insured and don’t realise there’s an issue. Financial counsellors, in the wake of disasters, report huge rates of underinsurance, but there’s been no data. It’s a difficult problem to resolve, but we don’t have state intervention the way other countries have, so it’s left to the market.

“We’re experiencing more frequent and severe natural hazard events, which is making insurance costly and exposing gaps in insurer capacity to process claims,” says Labor MP Daniel Mulino, the chair of the parliamentary inquiry. “We expect insurers to improve their communication with consumers and do the right thing by their customers by addressing any gaps in their processes.”QBE’s revenue increased 10 per cent to $20.8 billion in 2023, while its profit jumped 118 per cent to $1.

Many of the issues ASIC found are echoed in a landmark Deloitte review into the industry commissioned by the Insurance Council of Australia, which found a failure of systems, processes and resources. In his letter to insurance companies, Kirkland wrote he was concerned insurance companies were still not adequately resourcing their dispute resolution teams.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Israel Hamas: Why Israel will press ahead and invade Rafah in southern GazaThe Israeli leadership sees its war against Hamas as one element of a broader geopolitical rearrangement driven by Russia, China and Iran – and says the West should be worried.

Israel Hamas: Why Israel will press ahead and invade Rafah in southern GazaThe Israeli leadership sees its war against Hamas as one element of a broader geopolitical rearrangement driven by Russia, China and Iran – and says the West should be worried.

Read more »

The Age cleans up with the biggest haul at the Melbourne Press Club Quill AwardsThis masthead’s journalists, photographers, artists and designers won 11 awards and were highly commended 16 times across 31 categories at a ceremony on Friday night.

The Age cleans up with the biggest haul at the Melbourne Press Club Quill AwardsThis masthead’s journalists, photographers, artists and designers won 11 awards and were highly commended 16 times across 31 categories at a ceremony on Friday night.

Read more »

Biden’s team wards off press as he takes questions at campaign stop: ‘This is bad’President Biden’s team on Thursday quickly removed the press when he said he would take questions at an event in Saginaw, Michigan, and social media users blasted the 'incredible scene.'

Biden’s team wards off press as he takes questions at campaign stop: ‘This is bad’President Biden’s team on Thursday quickly removed the press when he said he would take questions at an event in Saginaw, Michigan, and social media users blasted the 'incredible scene.'

Read more »

Quill awards 2024: Guardian journalists win a Melbourne Press Club award for pedestrian deaths investigationNino Bucci and Blake Sharp-Wiggins revealed ‘stark details’ of the overrepresentation of Aboriginal people in roadside accidents

Quill awards 2024: Guardian journalists win a Melbourne Press Club award for pedestrian deaths investigationNino Bucci and Blake Sharp-Wiggins revealed ‘stark details’ of the overrepresentation of Aboriginal people in roadside accidents

Read more »

Benjamin Netanyahu vows to press ahead with Rafah assault plan, amid US criticismIsraeli Prime Minister Benjamin Netanyahu has vowed to push ahead with an offensive on the city of Rafah, railing against growing global criticism.

Benjamin Netanyahu vows to press ahead with Rafah assault plan, amid US criticismIsraeli Prime Minister Benjamin Netanyahu has vowed to push ahead with an offensive on the city of Rafah, railing against growing global criticism.

Read more »

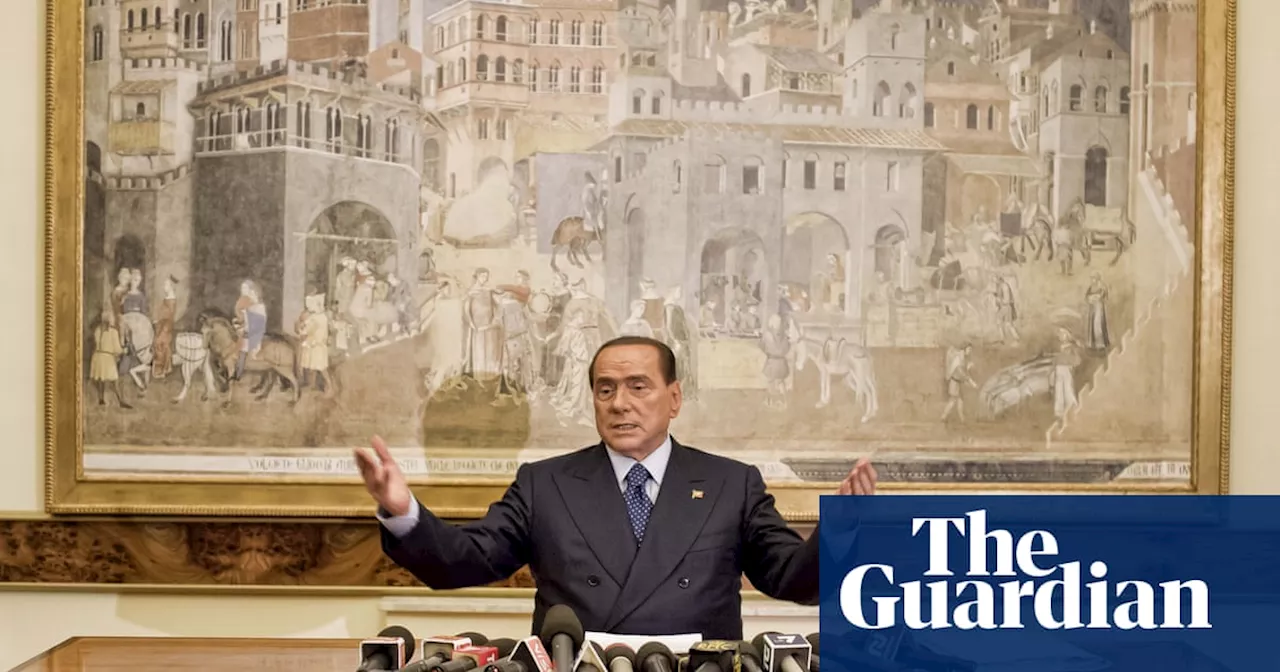

Bulletproof windows and ‘bunga bunga’: Berlusconi’s palace to be used by world’s pressItaly’s Foreign Press Association – branded ‘communists’ by late politician – moves into Palazzo Grazioli in Rome

Bulletproof windows and ‘bunga bunga’: Berlusconi’s palace to be used by world’s pressItaly’s Foreign Press Association – branded ‘communists’ by late politician – moves into Palazzo Grazioli in Rome

Read more »