US Dollar Price Analysis: Bears taking out short-term structure, 103 vulnerable of a test below By fx_ross DollarIndex Fed Technical Analysis

While it has been breaking the short-term structure and the trend from 101.297, as illustrated below, the long-term bullish playbook remains very much in play, at least from a technical standpoint.

The recent bearish impulse took out a number of short-term higher lows in a break of structures . Therefore, the downside is to play for. However, there is a price imbalance that could be mitigated prior to a full-on move to the downside. The break of structure led to a higher high. What could be playing out is a mere run on liquidity across the various currencies supporting the index and the US dollar, aka, a healthy correction in the. In the DXY index, there has already been a 61.8% Fibo correction to 103.33 and a touch below where the price rallied.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

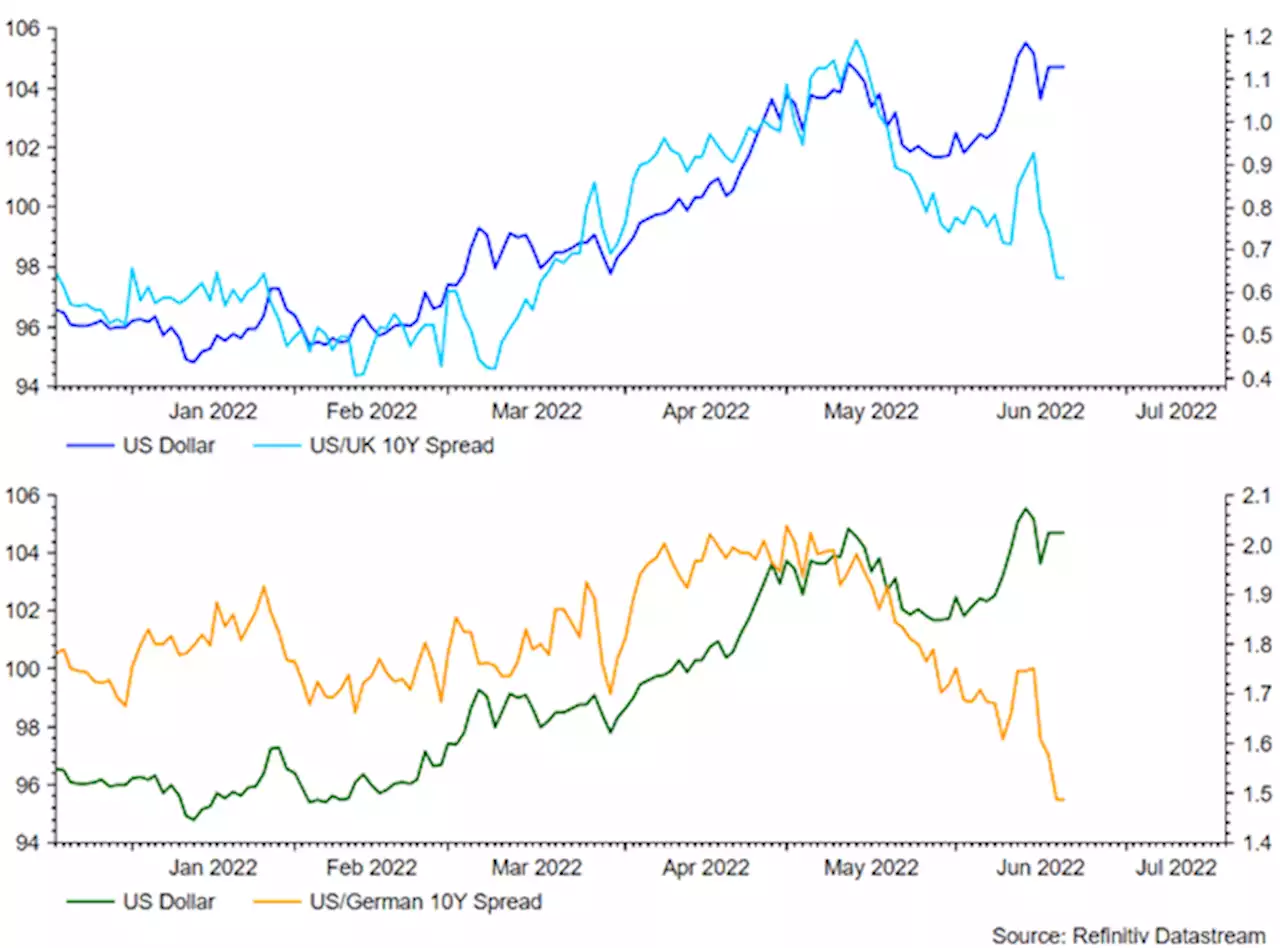

US Dollar Price Action: Is The US Dollar Peaking?After a subdued start to the week following yesterday’s US holiday, the USD is softer across the board this morning, dipping below the 104 as the Euro bounces back from the 1.05 handle, while GBP breaches 1.23. Get your market update from JMcQueenFX here:

US Dollar Price Action: Is The US Dollar Peaking?After a subdued start to the week following yesterday’s US holiday, the USD is softer across the board this morning, dipping below the 104 as the Euro bounces back from the 1.05 handle, while GBP breaches 1.23. Get your market update from JMcQueenFX here:

Read more »

Walmart Deep Dive Analysis: Hold WMT to play defense vs upcoming US recessionWelcome back to our deep dive series where this time we focus on the consumer sector with Walmart (WMT). As per usual we will look at both fundamental

Walmart Deep Dive Analysis: Hold WMT to play defense vs upcoming US recessionWelcome back to our deep dive series where this time we focus on the consumer sector with Walmart (WMT). As per usual we will look at both fundamental

Read more »

US Dollar Index: Bulls regain control and target 105.00, focus on PowellThe greenback, in terms of the US Dollar Index (DXY), regains the smile and approaches to the 105.00 mark on Wednesday. US Dollar Index looks to Powel

US Dollar Index: Bulls regain control and target 105.00, focus on PowellThe greenback, in terms of the US Dollar Index (DXY), regains the smile and approaches to the 105.00 mark on Wednesday. US Dollar Index looks to Powel

Read more »

U.S. in talks with allies on Russian oil price cap, says YellenThe United States is in talks with Canada and other allies to further restrict Moscow's energy revenue by imposing a price cap on Russian oil, Treasury Secretary Janet Yellen said on Monday.

U.S. in talks with allies on Russian oil price cap, says YellenThe United States is in talks with Canada and other allies to further restrict Moscow's energy revenue by imposing a price cap on Russian oil, Treasury Secretary Janet Yellen said on Monday.

Read more »

What the data tells us about gun violence in the USAccording to data compiled by William Paterson University, in the 20 years from 1998 to 2019, there were 101 mass shootings, defined by four or more people killed and injured, in the United States.

What the data tells us about gun violence in the USAccording to data compiled by William Paterson University, in the 20 years from 1998 to 2019, there were 101 mass shootings, defined by four or more people killed and injured, in the United States.

Read more »

Russian Ruble Taps 7-Year High Against the US Dollar — Economist Says 'Don’t Ignore the Exchange Rate' – Economics Bitcoin NewsOn Monday, Russia's ruble had risen to its highest value against the USdollar since 2015 and economists have been discussing the issue. Economics

Russian Ruble Taps 7-Year High Against the US Dollar — Economist Says 'Don’t Ignore the Exchange Rate' – Economics Bitcoin NewsOn Monday, Russia's ruble had risen to its highest value against the USdollar since 2015 and economists have been discussing the issue. Economics

Read more »