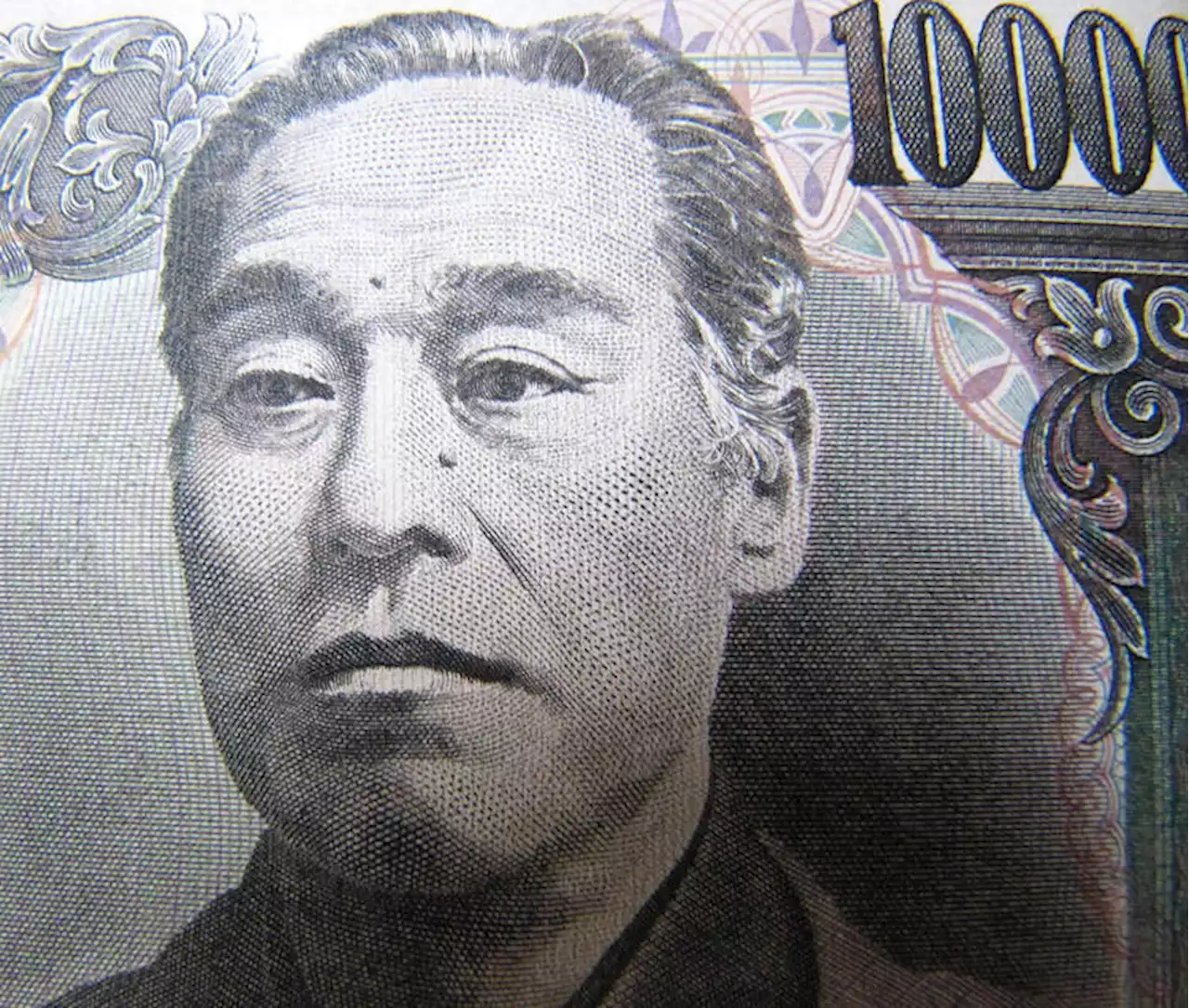

USD/JPY continued its decline from the Asian into the European session following the Bank of Japan’s unplanned bond purchase operation, the second in a day. Get your market update from zvawda here:

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX PUBLICATIONS IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

FX Publications Inc is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association . Registered Address: 19 North Sangamon Street, Chicago, IL 60607. FX Publications Inc is a subsidiary of IG US Holdings, Inc

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY breaks above 133.50 as BOJ’s summary of opinions support easy policy outlookThe USD/JPY pair has delivered an upside break after displaying topsy-turvy moves around 133.50 in the Asian session. The expectations of the continua

USD/JPY breaks above 133.50 as BOJ’s summary of opinions support easy policy outlookThe USD/JPY pair has delivered an upside break after displaying topsy-turvy moves around 133.50 in the Asian session. The expectations of the continua

Read more »

USD/JPY Price Analysis: 50-SMA probes bulls near 134.00USD/JPY seesaws around 134.00 as bulls keep the reins during a five-day uptrend near the weekly top. In doing so, the Yen pair pokes the 50-SMA level

USD/JPY Price Analysis: 50-SMA probes bulls near 134.00USD/JPY seesaws around 134.00 as bulls keep the reins during a five-day uptrend near the weekly top. In doing so, the Yen pair pokes the 50-SMA level

Read more »

USD/JPY recovery falters at 134.40: the pairretreats below 134.00The US Dollar has lost ground against the Japanese yen ahead of Wednesday’s European session opening. The pair is trimming gains after a solid market

USD/JPY recovery falters at 134.40: the pairretreats below 134.00The US Dollar has lost ground against the Japanese yen ahead of Wednesday’s European session opening. The pair is trimming gains after a solid market

Read more »

USD/JPY to extend its fall toward 127.47/27 – Credit SuisseEconomists at Credit Suisse believe USD/JPY has seen an important peak in 2022 and look for further weakness to 127.47/27. USD/JPY has established a m

USD/JPY to extend its fall toward 127.47/27 – Credit SuisseEconomists at Credit Suisse believe USD/JPY has seen an important peak in 2022 and look for further weakness to 127.47/27. USD/JPY has established a m

Read more »

USD/JPY to see a deeper downtrend on failure to defend 130.40 – SocGenUSD/JPY met projections near 150/152 in October and has embarked on a steady pullback. A break under 130.40 would open up further losses towards 128,

USD/JPY to see a deeper downtrend on failure to defend 130.40 – SocGenUSD/JPY met projections near 150/152 in October and has embarked on a steady pullback. A break under 130.40 would open up further losses towards 128,

Read more »

USD/JPY Price Analysis: Remains below the 200-DMA, albeit reclaiming 134.00The USD/JPY has advanced steadily since the December 20 500-pip fall after the Bank of Japan (BoJ) removed the cap of 0.25% to the 10-year Japanese Go

USD/JPY Price Analysis: Remains below the 200-DMA, albeit reclaiming 134.00The USD/JPY has advanced steadily since the December 20 500-pip fall after the Bank of Japan (BoJ) removed the cap of 0.25% to the 10-year Japanese Go

Read more »