USDCHF sees a downside below 0.9830 amid weaker DXY, US Inflation hogs limelight – by Sagar_Dua24 USDCHF SNB Fed Inflation YieldCurve

around its fresh two-week low at 1.3869 and is expected to surrender the same amid a risk-on market mood.

A meaningful recovery in S&P500 in the late New York session cleared that the risk-perceived currencies are on the buying list of the market participants. Meanwhile, the USThe alpha generated by the US governmenthas slipped sharply as investors see no continuation of the bigger rate hike announcement by the Federal Reserve . The 10-year US Treasury yields have dropped to 2.13% as the room for bigger rate hikes is extremely low now.

The deviation between current interest rates and the proposed terminal rate is mere 80 basis points now. Therefore, Fed chairis expected to adopt a gradual approach to hiking policy rates. In case of the absence of exhaustion in October’s inflation report, Fed policymakers could come forward with higher targets for interest rates and the central bank would continue hikingAs per the preliminary estimates, the headline inflation is seen lower at 8.0% vs. the prior release of 8.2%.

The central bank is not committed to fine-tuning the inflation range at 0-2% but will take necessary action when will face the risk of soaring inflation. He further added that “We are also experimenting with machine-learning models that are trained using a large set of economic and alternative indicators.”

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USDCHF Price Analysis: Bears poke 50-day EMA, five-week-old support line below 0.9900USDCHF Price Analysis: Bears poke 50-day EMA, five-week-old support line below 0.9900 – by anilpanchal7 USDCHF Technical Analysis SwingTrading ChartPatterns SupportResistance

USDCHF Price Analysis: Bears poke 50-day EMA, five-week-old support line below 0.9900USDCHF Price Analysis: Bears poke 50-day EMA, five-week-old support line below 0.9900 – by anilpanchal7 USDCHF Technical Analysis SwingTrading ChartPatterns SupportResistance

Read more »

USDCHF Price Analysis: Drops below parity, extending its losses towards the 50-DMAThe USDCHF tumbles for the second straight day and falls beneath the 50-day Exponential Moving Average (EMA) as the American Dollar gets battered acro

USDCHF Price Analysis: Drops below parity, extending its losses towards the 50-DMAThe USDCHF tumbles for the second straight day and falls beneath the 50-day Exponential Moving Average (EMA) as the American Dollar gets battered acro

Read more »

USDCHF stays firmer past 0.9900 with eyes on SNB’s Jordan, US electionsUSDCHF prints mild gains around 0.9915 while snapping a two-day downtrend around the lowest level in a week. In doing so, the Swiss Franc (CHF) pair p

USDCHF stays firmer past 0.9900 with eyes on SNB’s Jordan, US electionsUSDCHF prints mild gains around 0.9915 while snapping a two-day downtrend around the lowest level in a week. In doing so, the Swiss Franc (CHF) pair p

Read more »

EURUSD inclines towards 0.9950 as DXY turns sideways, Eurozone Retail Sales eyedThe EURUSD pair is marching gradually toward the immediate hurdle of 0.9950 in the Tokyo session. The asset is mostly trading sideways amid mixed resp

EURUSD inclines towards 0.9950 as DXY turns sideways, Eurozone Retail Sales eyedThe EURUSD pair is marching gradually toward the immediate hurdle of 0.9950 in the Tokyo session. The asset is mostly trading sideways amid mixed resp

Read more »

USDCHF falls to weekly lows under 0.9900The USDCHF is falling on Monday for the second day in a row and it dropped to 0.9874, reaching the lowest level since October 27. It is hovering sligh

USDCHF falls to weekly lows under 0.9900The USDCHF is falling on Monday for the second day in a row and it dropped to 0.9874, reaching the lowest level since October 27. It is hovering sligh

Read more »

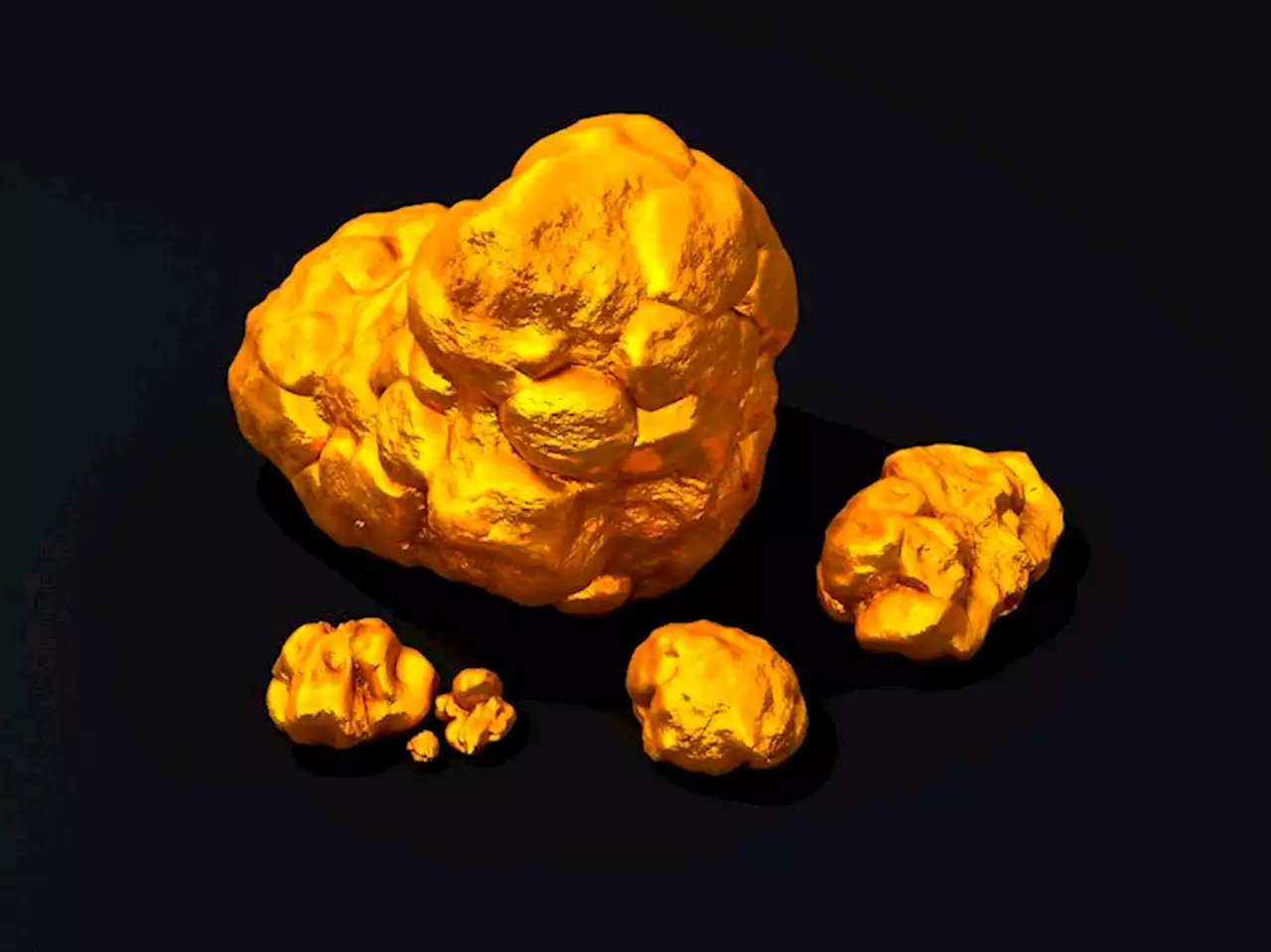

Gold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyedGold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyed – by anilpanchal7 Gold XAUUSD Inflation US Elections Commodities

Gold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyedGold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyed – by anilpanchal7 Gold XAUUSD Inflation US Elections Commodities

Read more »