Berkshire has had an excellent 2022, while the broader market has floundered.

During the long, tech-driven bull market, you may have seen more than one article suggesting Berkshire Hathaway CEO Warren Buffett’s investing style was no longer valid.

With Buffett leading the conglomerate’s annual meeting on April 30, this is a good time to take a fresh look at Berkshire’s performance. The notion that Buffett is outdated may itself be outdated. Berkshire’s returns have beaten those of the Dow and the S&P 500 for all the periods shown above, strikingly so for the longer periods.

But Buffett explains the company’s advantages in his annual letters to shareholders, including the “float” from its core insurance businesses and the high levels of free cash flow he and his colleagues have emphasized when making acquisitions over the decades. Berkshire’s investment portfolio Publicly traded corporations that invest in other companies’ common shares, but haven’t incorporated those businesses into their own financial statements, are required by the Securities and Exchange Commission to report their stock holdings within 45 days of the end of each fiscal quarter. These are known as 13F filings. Berkshire’s most recent 13F was filed on Feb. 14 and listed holdings as of Dec. 31.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Berkshire Hathaway’s annual meeting is here: What to expect from Warren Buffett and Charlie MungerInvestors around the globe are waiting to hear from Warren Buffett, along with his right-hand man Charlie Munger, following a flurry of investment activities.

Berkshire Hathaway’s annual meeting is here: What to expect from Warren Buffett and Charlie MungerInvestors around the globe are waiting to hear from Warren Buffett, along with his right-hand man Charlie Munger, following a flurry of investment activities.

Read more »

At 91, Warren Buffett still sprints circles around Wall StreetAfter a two-year pandemic-induced haitus, the only shareholder meeting of its kind on the planet is back and could break its own stunning record. Tens of thousands from around the world will descend on Omaha, Nebraska--the birthplace of the 'Oracle of Omaha,' a.k.a. Warren Buffett.

At 91, Warren Buffett still sprints circles around Wall StreetAfter a two-year pandemic-induced haitus, the only shareholder meeting of its kind on the planet is back and could break its own stunning record. Tens of thousands from around the world will descend on Omaha, Nebraska--the birthplace of the 'Oracle of Omaha,' a.k.a. Warren Buffett.

Read more »

Warren Buffett's 'Woodstock for Capitalists' a smaller affair after pandemicWarren Buffett's Berkshire Hathaway Inc will hold its annual shareholder meeting in person on Saturday for the first time since before the pandemic, but the extravaganza dubbed 'Woodstock for Capitalists' is likely to see fewer people and pared-back events.

Warren Buffett's 'Woodstock for Capitalists' a smaller affair after pandemicWarren Buffett's Berkshire Hathaway Inc will hold its annual shareholder meeting in person on Saturday for the first time since before the pandemic, but the extravaganza dubbed 'Woodstock for Capitalists' is likely to see fewer people and pared-back events.

Read more »

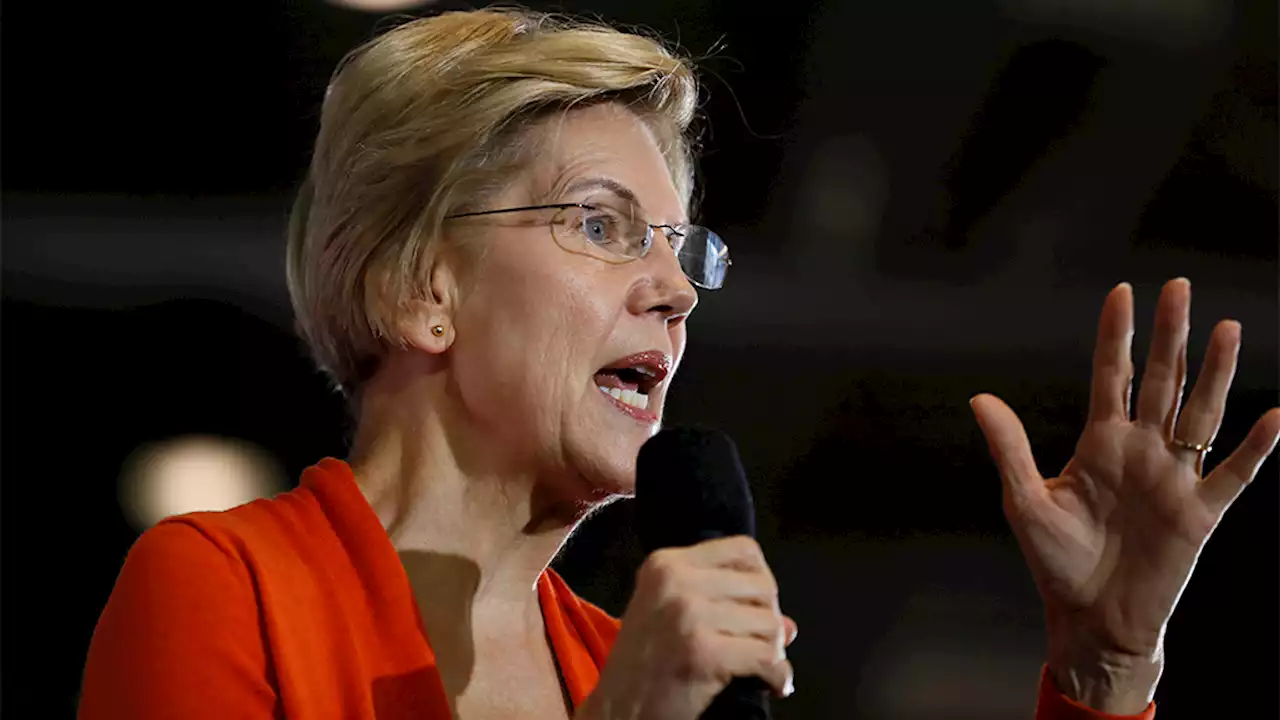

Elizabeth Warren calls for new 'rules' to govern 'unregulated' social media amid Musk's Twitter takeoverSen. Elizabeth Warren, D-Mass., called for new 'rules' to govern Big Tech companies amid the takeover of Twitter by Tesla CEO Elon Musk.

Elizabeth Warren calls for new 'rules' to govern 'unregulated' social media amid Musk's Twitter takeoverSen. Elizabeth Warren, D-Mass., called for new 'rules' to govern Big Tech companies amid the takeover of Twitter by Tesla CEO Elon Musk.

Read more »

What to watch for at Warren Buffett’s ‘Woodstock for Capitalists’ in Omaha on SaturdayThousands of Berkshire Hathaway shareholders are off to Omaha this weekend for what’s known as “Woodstock for Capitalists,” where Warren Buffett will be meeting them in person for the first time since 2019. Here are a few topics to watch out for.

What to watch for at Warren Buffett’s ‘Woodstock for Capitalists’ in Omaha on SaturdayThousands of Berkshire Hathaway shareholders are off to Omaha this weekend for what’s known as “Woodstock for Capitalists,” where Warren Buffett will be meeting them in person for the first time since 2019. Here are a few topics to watch out for.

Read more »