If approved, a restructuring deal will allow the fallen co-working giant exit bankruptcy with less debt and a leaner, less expensive lease portfolio.

Already a subscriber?WeWork and its major financial backers, including SoftBank Group, have struck a new restructuring deal to get the ailing workspace provider out of bankruptcy, spurning a competing financing proposal from co-founder Adam Neumann.

Co-founded by Adam Neumann and Miguel McKelvey in 2010, WeWork had a meteoric rise before a stunning fall.The restructuring deal represents a major milestone for the company after it filed for bankruptcy in November. If approved by the court, the business will be on a path to exit court protection in the coming months with less debt and a leaner, less expensive lease portfolio.

Eli Vonnegut, a lawyer representing a senior lender group backing the deal, said the agreement “is some of the best news we’ve had in this case”, and the company now has a “fast and reliable path out of bankruptcy”. WeWork needs to leave bankruptcy as quickly as possible because the Chapter 11 case has been extremely expensive and administrative costs incurred during the case aren’t sustainable, he said.

WeWork’s advisors have refused to negotiate with him and agreed to the restructuring transaction without public bidding on the firm’s assets, Neumann’s attorney, Susheel Kirpalani, said during the hearing.US bankruptcy judge John K. Sherwood said it was up to the lenders, who are owed billions of dollars, to decide whether or not to negotiate with Mr Neumann.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ASX bank stocks: ‘Sell everything’ hard to put into practice for bank stocksThe big banks’ share prices have got ahead of their earnings outlook, but that doesn’t mean investors are dropping them en masse.

ASX bank stocks: ‘Sell everything’ hard to put into practice for bank stocksThe big banks’ share prices have got ahead of their earnings outlook, but that doesn’t mean investors are dropping them en masse.

Read more »

AMP shares: AMP quietly begins restructure for $60m digital bank project with UK’s Starling BankUp to 35 jobs will be lost as 83 employees see their teams or reporting lines change.

AMP shares: AMP quietly begins restructure for $60m digital bank project with UK’s Starling BankUp to 35 jobs will be lost as 83 employees see their teams or reporting lines change.

Read more »

Regional banks such as Bank of Queensland and Bendigo Bank dying a slow deathThe country’s smaller banks have a bleak future due to higher cost of funds, excessive capital requirements, costly technology upgrades and lack of scale. But will regulators do anything about it?

Regional banks such as Bank of Queensland and Bendigo Bank dying a slow deathThe country’s smaller banks have a bleak future due to higher cost of funds, excessive capital requirements, costly technology upgrades and lack of scale. But will regulators do anything about it?

Read more »

Ben Bernanke’s Bank of England review: How ‘flamethrowers’ and creaking IT burnt the central bankFor more than three decades, the BoE has used fan charts to visualise the uncertainty surrounding its forecasts. As Ben Bernanke pointed out, most people have no idea what they mean.

Ben Bernanke’s Bank of England review: How ‘flamethrowers’ and creaking IT burnt the central bankFor more than three decades, the BoE has used fan charts to visualise the uncertainty surrounding its forecasts. As Ben Bernanke pointed out, most people have no idea what they mean.

Read more »

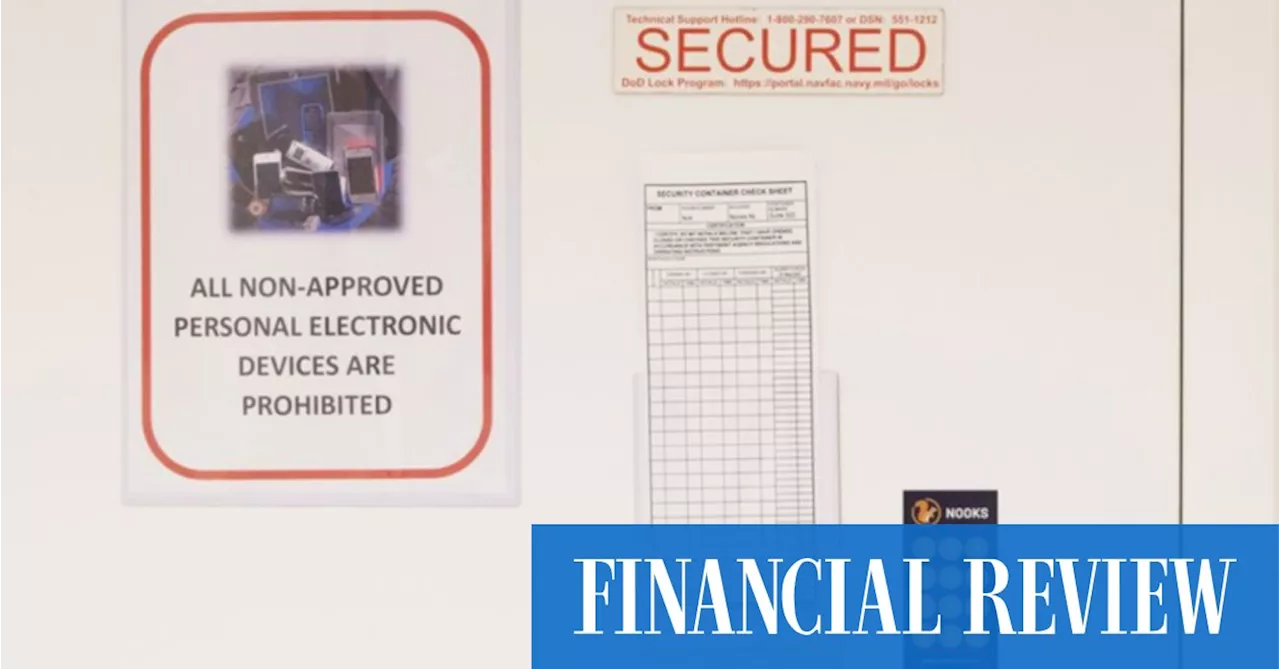

WeWork for spies is the newest co-working development from companies such as NooksIn this co-working space, only the cappuccino isn’t classified. Servicing the spook sector is a rare bright spot in the market for office facilities,

WeWork for spies is the newest co-working development from companies such as NooksIn this co-working space, only the cappuccino isn’t classified. Servicing the spook sector is a rare bright spot in the market for office facilities,

Read more »

WeWork predicts $12b in rent savings after bankruptcy endsThe co-working company’s plan to reduce its real estate comes as it separately fields an offer by Adam Neumann to buy back the company he co-founded.

WeWork predicts $12b in rent savings after bankruptcy endsThe co-working company’s plan to reduce its real estate comes as it separately fields an offer by Adam Neumann to buy back the company he co-founded.

Read more »