I am author of the book 'Caring for Our Parents' and senior fellow at The Urban Institute, where I am affiliated with the Tax Policy Center and the Program on Retirement Policy. I also write a tax and budget policy blog, TaxVox, which you may read at Forbes.com or at http://taxvox.taxpolicycenter.org/ Before joining Urban, I was a senior correspondent in the Washington bureau of Business Week.

Payments to Alaska residents from the state’s Permanent Fund Dividend program are subject to federal income tax. In New York, the Tax Court ruled in 2015 that the refundable portion of New York state business tax credits should be treated as taxable income,Similarly, some versions of a universal basic income make those payments taxable.

Taxing child credits is not ideal. It would set a precedent for refundable tax credits that could trouble many advocates for government assistance programs. At the same time, it would result in a tax cut for very high-income households with children. Lawmakers also might want to distinguish credits as income for tax purposes from income used to determine eligibility for other government assistance such as Medicaid.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Speaker Gunn's hallmark plan to eliminate income tax, reduce food tax passes committeeSpeaker Philip Gunn’s latest proposal to phase out the state income tax and to reduce the sales tax on groceries was quickly passed out of the House Ways and Means Committee on Tuesday.

Speaker Gunn's hallmark plan to eliminate income tax, reduce food tax passes committeeSpeaker Philip Gunn’s latest proposal to phase out the state income tax and to reduce the sales tax on groceries was quickly passed out of the House Ways and Means Committee on Tuesday.

Read more »

Q&A: Here’s how working from home could change your 2022 city tax withholdings and billsNow, the state law has changed and, your employer must withhold local income taxes based on where you are actually working. For those working from home, this could mean big, and sometimes complicated, changes, with a lot of dollars involved.

Q&A: Here’s how working from home could change your 2022 city tax withholdings and billsNow, the state law has changed and, your employer must withhold local income taxes based on where you are actually working. For those working from home, this could mean big, and sometimes complicated, changes, with a lot of dollars involved.

Read more »

Here’s how rising inflation may affect your 2021 tax billInflation is still rising, and while many notice the surge in day-to-day expenses, climbing prices may also affect your tax bill, experts say.

Here’s how rising inflation may affect your 2021 tax billInflation is still rising, and while many notice the surge in day-to-day expenses, climbing prices may also affect your tax bill, experts say.

Read more »

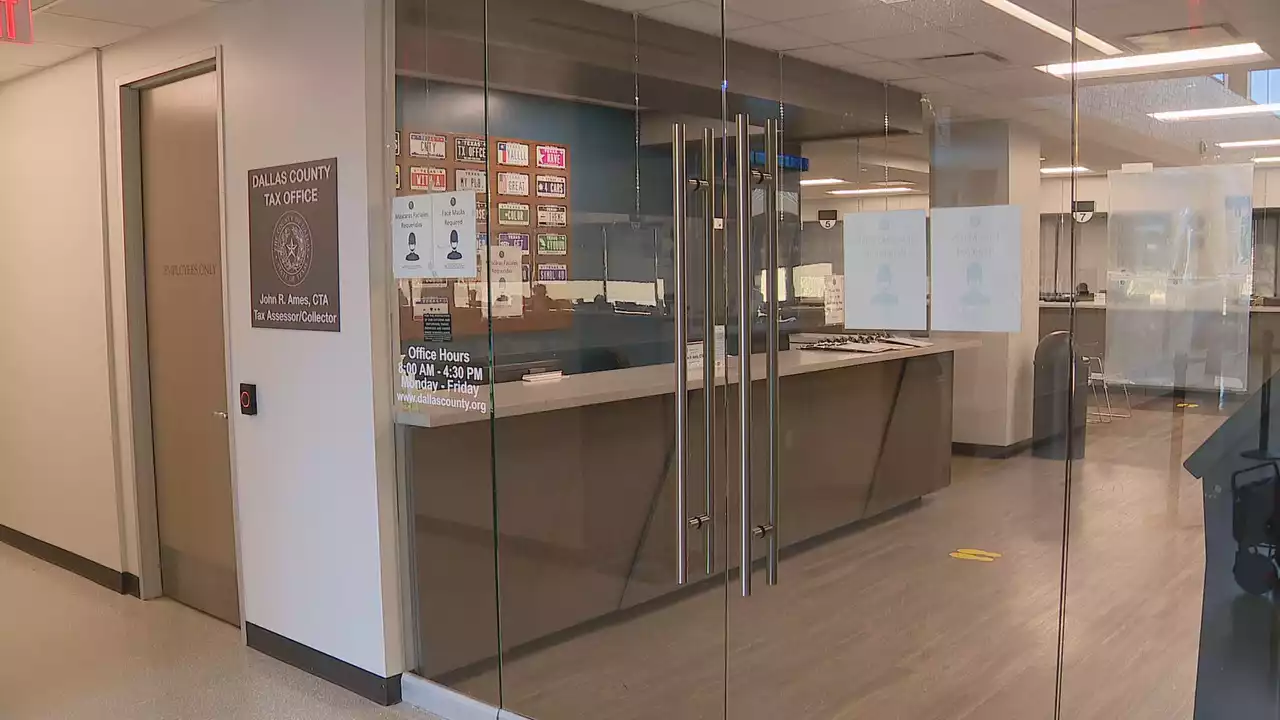

Dallas County tax offices closed due to COVID outbreak among employeesDallas County tax offices are closed to the public until further notice. Instead, workers are processing paperwork online or by the phone. County Leaders blame spiking COVID cases among employees and an effort to cut down indoor crowds.

Dallas County tax offices closed due to COVID outbreak among employeesDallas County tax offices are closed to the public until further notice. Instead, workers are processing paperwork online or by the phone. County Leaders blame spiking COVID cases among employees and an effort to cut down indoor crowds.

Read more »