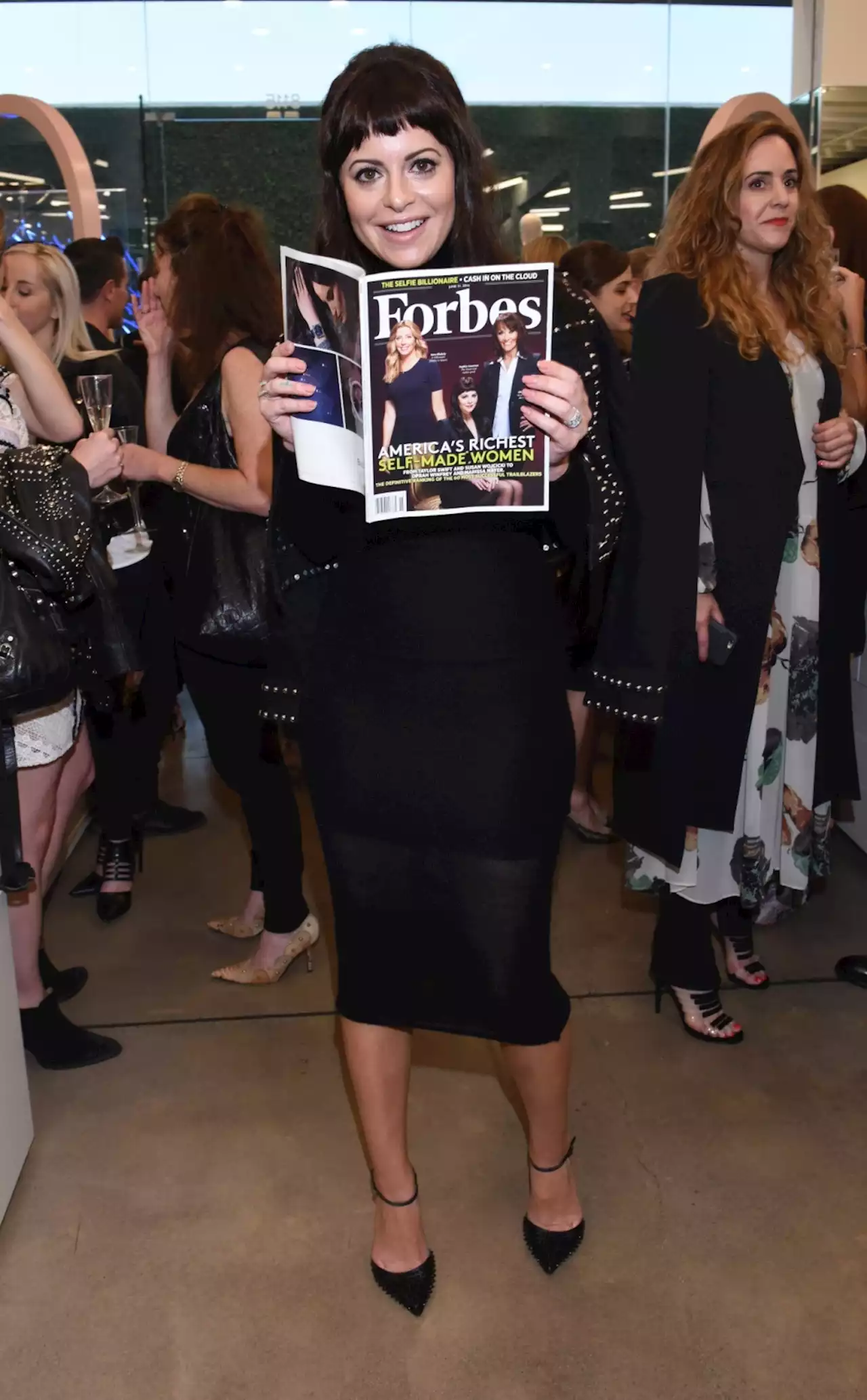

After Forbes cancels its planned stock market debut, WWD looks at what happened to all the digital media companies that had SPAC hopes.

But as with anything, a lot can change in a year, and many of those companies that were excited about SPACs have since changed their tune.

“Our digital transformation has delivered double-digit revenue and EBITDA growth over the past year, which not only significantly outperformed the financial targets provided at the start of the SPAC transaction last year but continues to deliver high-quality cashflows and compelling year-over-year and sequential growth since then,” said Mike Federle, CEO of Forbes.

“I think it’s important to consider the economic drivers of SPACs. Functionally, the SPAC target IPO is being used as an alternative means to conduct an IPO,” SEC Chair Gary Gensler said in March. “Thus, investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud and conflicts, and when it comes to disclosure, marketing practices, gatekeepers and issuers.

“I want to take this company public; I’ve admitted that in the past. I’ve never said it quite this clearly….I think that the SPAC revolution that’s taken place in the last year, it’s not for every start-up, but I do think it’s a good fit for this start-up.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Binance-Supported Deal for Forbes to Go Public Via SPAC Is Called Off: ReportThe Binance-supported deal for Forbes to go public via a SPAC has been called off, according to a report in The New York Times. By mikeybellusci

Binance-Supported Deal for Forbes to Go Public Via SPAC Is Called Off: ReportThe Binance-supported deal for Forbes to go public via a SPAC has been called off, according to a report in The New York Times. By mikeybellusci

Read more »

Binance is 'reviewing all possible options' for Forbes investment after scrapped SPACCrypto exchange Binance may still invest in Forbes, despite reports that the media firm has cancelled plans to go public through a SPAC deal.

Binance is 'reviewing all possible options' for Forbes investment after scrapped SPACCrypto exchange Binance may still invest in Forbes, despite reports that the media firm has cancelled plans to go public through a SPAC deal.

Read more »

Forbes to ditch SPAC funding plan: NYTThe New York Times reported Tuesday that Forbes has canceled its plan to raise funds via a special purpose acquisition vehicle or SPAC.

Forbes to ditch SPAC funding plan: NYTThe New York Times reported Tuesday that Forbes has canceled its plan to raise funds via a special purpose acquisition vehicle or SPAC.

Read more »

Breakingviews - Geely-backed auto SPAC deal revs up too fastLi Shufu is in the fast lane again. Geely’s founder who is best known for buying Swedish carmaker Volvo has signed up for the largest listing of a company hailing from the People's Republic through a special-purpose acquisition company. It’s a bold move with ride-hailing company Didi's experience as a public company in New York still so raw.

Breakingviews - Geely-backed auto SPAC deal revs up too fastLi Shufu is in the fast lane again. Geely’s founder who is best known for buying Swedish carmaker Volvo has signed up for the largest listing of a company hailing from the People's Republic through a special-purpose acquisition company. It’s a bold move with ride-hailing company Didi's experience as a public company in New York still so raw.

Read more »

Forbes to ditch SPAC funding plan: NYTThe New York Times reported Tuesday that Forbes has canceled its plan to raise funds via a special purpose acquisition vehicle or SPAC.

Forbes to ditch SPAC funding plan: NYTThe New York Times reported Tuesday that Forbes has canceled its plan to raise funds via a special purpose acquisition vehicle or SPAC.

Read more »

SPACs go back, but with no futureA freight firm with little revenue and ambitious projections agreed to a $500 mln blank check merger, while Forbes has called its SPAC tie-up off. Looming regulations have taken the shine off these once-popular deals. Banks and companies who stay the course are taking a risk.

SPACs go back, but with no futureA freight firm with little revenue and ambitious projections agreed to a $500 mln blank check merger, while Forbes has called its SPAC tie-up off. Looming regulations have taken the shine off these once-popular deals. Banks and companies who stay the course are taking a risk.

Read more »