Australian shares are poised for growth as Wall Street's tariff turbulence eases, while the Australian dollar strengthens. Meanwhile, global financial news involves fluctuating tech stocks, US automotive losses, potential trade developments, and energy field partnerships.

Australian shares are poised for an upward trend as the turbulence surrounding tariffs on Wall Street subsides. Simultaneously, the local currency has regained momentum, approaching 63 US cents. In the realm of technology stocks, Alphabet, the parent company of Google, witnessed a decline in share price following its commitment to substantial AI funding. Conversely, Nvidia experienced a surge, demonstrating investor confidence in its ability to navigate the recent DeepSeek controversy.

For comprehensive coverage of today's financial news and insightful analysis from our dedicated business reporters, please refer to our live blog.Donald Trump's declaration of the United States' intention to assume control of Gaza and transform it into the 'Riviera of the Middle East' has profound implications for regional stability and financial markets, according to Matthew Haupt, lead portfolio manager at Wilson Asset Management. He contends that this announcement will exacerbate existing tensions in the region, particularly at a time when Iran's oil production is already under duress due to US sanctions. Haupt further predicts an escalation in disruptions to the oil supply chain, potentially leading to a rise in global oil prices.Matthew Haupt also emphasizes the market's imperative for clarity regarding tariffs. He underscores the significance of a resolution to the trade dispute with China, positing that the current trade tensions are contributing to uncertainty and potentially fueling market volatility. In a separate development, US automotive giant Ford Motor anticipates incurring losses of up to US$5.5 billion in its electric vehicle and software operations this year. This projected loss mirrors last year's figures and highlights the formidable challenges in reducing costs associated with battery-powered models.If implemented, the proposed measures would significantly increase the automaker's raw material expenses and likely dampen consumer demand. 'There is no question that 25% tariffs on Mexico and Canada would have a major impact on our industry,' Ford's incoming chief financial officer, Sherry House, stated in a press conference on Wednesday.East Timor has expressed its preference for collaborating with Australia and its partners, Woodside Energy and Japan's Osaka Gas, in the development of the Greater Sunrise natural gas field, rather than engaging with Chinese firms. Chinese companies have evinced interest in developing this stalled natural gas field. The remarks made by President Jose Ramos-Horta in an interview with Reuters mark the first occasion on which he has publicly articulated his preference to develop the field with Australia and existing partners since he initially suggested engaging with new partners, including China and Kuwait.The prospect of developing Greater Sunrise, which boasts 5.1 trillion cubic feet of gas reserves, with new partners had engendered concerns in Australia regarding the escalating influence of China in the Pacific region. Ramos-Horta asserted that East Timor has been deferring approaches from Chinese companies, including state-owned Sinopec, as well as Kuwaiti firms, to develop the field because of its commitment to its Australian partners. 'If anything, it is our side that has been holding off,' Ramos-Horta stated in an interview conducted on Sunday during a commercial flight from Dili to Indonesia's Bali. State-owned Timor Gap holds a 56.6% stake in the field situated approximately 140 km (87 miles) south of East Timor, while Australia's Woodside owns 33.4% and Osaka Gas holds 10%. The multi-billion dollar development of the field, whose revenue was estimated at US$65 billion in 2018, has been stalled for decades due to disagreements with Australia and the operator, Woodside. It is crucial for the economic growth of Southeast Asia's poorest nation, also known as Timor-Leste, which gained independence from Indonesia in 2002.Nvidia, whose share price has experienced a decline exceeding 25% this year, rebounded by 5.1% overnight to US$124.83, tracking Super Micro Computer's 8% gain to US$31.49 after it announced full production for its AI data center utilizing Nvidia's Blackwell chip. Nvidia had previously dropped in value as investors questioned whether its stock was overvalued and a smaller Chinese competitor, DeepSeek, could potentially create AI software more efficiently without the need for its expensive chips.India plans to review import tariffs on over 30 items, including luxury cars, solar cells, and chemicals, according to a senior finance ministry official. This move is potentially being made in anticipation of increased imports from the US as global trade tensions escalate. The finance ministry official refrained from disclosing the timeframe for the completion of the consultation process, but industry analysts predict that the process could extend for several months.REA's total net profit surged by 246% to US$441 million, primarily attributed to a few one-off items, including the sale of its stake in Singapore property site PropertyGuru. On the executive front, the board has initiated the search for a new chief executive and indicated that Owen Wilson will remain with the company 'to ensure a smooth and orderly transition.'We will keep you abreast of the share price movement when the ASX opens, as well as any analyst reactions. Our colleague Rachel Clayton examines how inter-generational financial support extends beyond home deposits, encompassing expenses such as childcare, veterinary bills, and even mortgage payments and utility bills (although it's still a long way off!). The AUD is also strengthening against other currencies. For insights into the reasons behind its rise against the Euro, please refer to a note from CBA regarding French Prime Minister Bayrou's survival of a no-confidence motion yesterday.

FINANCE MARKETS AUSTRALIA TARIFFS OIL TECHNOLOGY AUTOMOTIVE

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Australian Shares Expected to Decline as Investors Await US Inflation DataAustralian shares are poised for a decline, tracking Wall Street's performance as investors anticipate the release of crucial US December inflation data. The market awaits insights into the Federal Reserve's rate-cutting cycle.

Australian Shares Expected to Decline as Investors Await US Inflation DataAustralian shares are poised for a decline, tracking Wall Street's performance as investors anticipate the release of crucial US December inflation data. The market awaits insights into the Federal Reserve's rate-cutting cycle.

Read more »

Australian Shares Climb for Fourth Day Amid Consumer OptimismAustralian shares rose for a fourth straight session, driven by the consumer discretionary sector as traders anticipate improved market sentiment in the new year. The S&P/ASX 200 Index gained 0.3%, boosted by consumer confidence, technology stocks, and domestically oriented sectors like healthcare. The Australian dollar also strengthened overnight.

Australian Shares Climb for Fourth Day Amid Consumer OptimismAustralian shares rose for a fourth straight session, driven by the consumer discretionary sector as traders anticipate improved market sentiment in the new year. The S&P/ASX 200 Index gained 0.3%, boosted by consumer confidence, technology stocks, and domestically oriented sectors like healthcare. The Australian dollar also strengthened overnight.

Read more »

Australian Shares Edge Higher Despite Mixed SentimentAustralian shares closed marginally higher on Tuesday, with technology stocks leading the gains while losses in miners and utilities tempered the overall performance.

Australian Shares Edge Higher Despite Mixed SentimentAustralian shares closed marginally higher on Tuesday, with technology stocks leading the gains while losses in miners and utilities tempered the overall performance.

Read more »

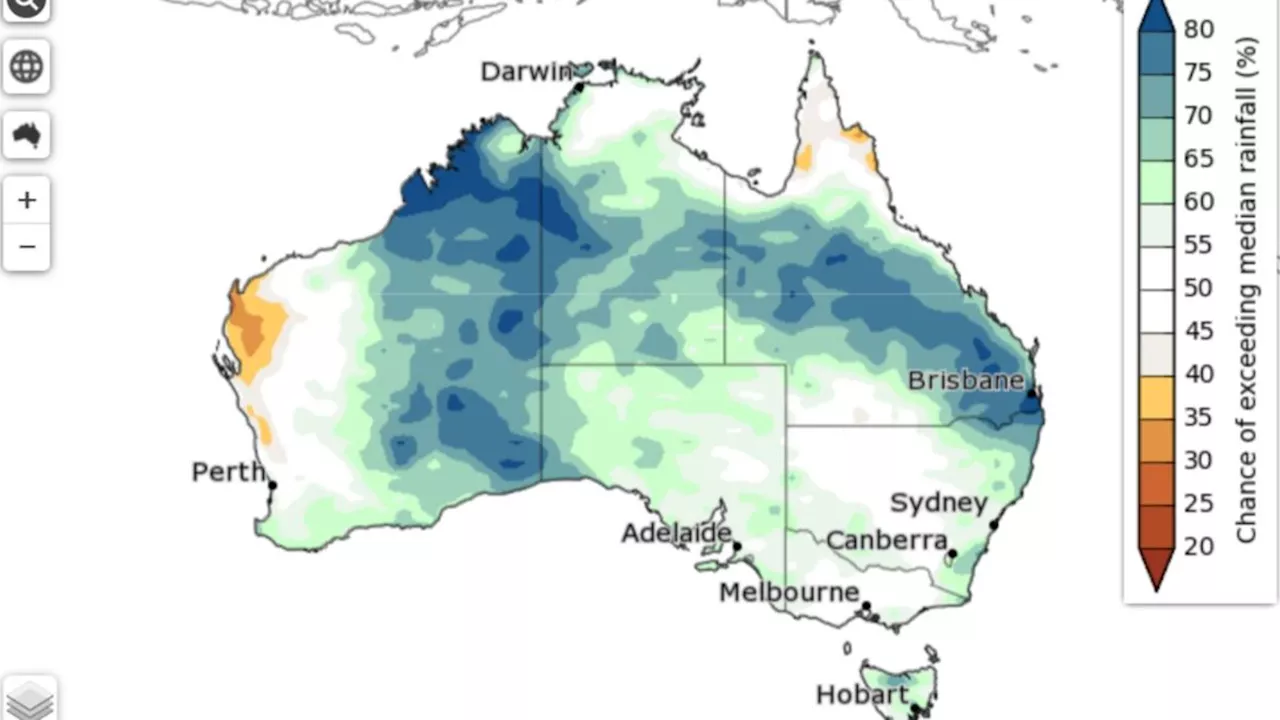

Late Summer La Nina Expected to Bring Wet Weather to AustraliaClimate experts predict a rare late summer La Nina event in 2024-2025, signaling increased rainfall for much of Australia. The Bureau of Meteorology (BOM) report highlights unusual ocean and atmosphere indicators pointing towards this development. This event comes amidst historically high global sea surface temperatures, further emphasizing the concerning trend.

Late Summer La Nina Expected to Bring Wet Weather to AustraliaClimate experts predict a rare late summer La Nina event in 2024-2025, signaling increased rainfall for much of Australia. The Bureau of Meteorology (BOM) report highlights unusual ocean and atmosphere indicators pointing towards this development. This event comes amidst historically high global sea surface temperatures, further emphasizing the concerning trend.

Read more »

ASX 200 LIVE: Australian shares are poised to open lower, November retail sales data awaitedAustralian shares are set to open lower. S&P 500 briefly trades below 5900. Retail sales data awaited. Bitcoin extends retreat. Follow updates here.

ASX 200 LIVE: Australian shares are poised to open lower, November retail sales data awaitedAustralian shares are set to open lower. S&P 500 briefly trades below 5900. Retail sales data awaited. Bitcoin extends retreat. Follow updates here.

Read more »

Australian Shares Fall Despite Retail Sales BoostAustralian shares closed lower on Thursday despite a 0.8% rise in monthly retail sales in November. The weaker Australian dollar, currently trading at US61.96 cents, and concerns about prolonged inflation influenced market sentiment. Star Entertainment shares dropped sharply after announcing a cash shortage, while Arcadium soared following the approval of Rio Tinto's takeover.

Australian Shares Fall Despite Retail Sales BoostAustralian shares closed lower on Thursday despite a 0.8% rise in monthly retail sales in November. The weaker Australian dollar, currently trading at US61.96 cents, and concerns about prolonged inflation influenced market sentiment. Star Entertainment shares dropped sharply after announcing a cash shortage, while Arcadium soared following the approval of Rio Tinto's takeover.

Read more »