Don't wait to buy I-Bonds or you'll risk losing out on an 8.54% yield for a full year.

On May 1 every year and November 1 the U.S. Treasury announces the interest rate to be paid for newly bought bonds and for ones being held.Fortunately, the U.S. Treasury Series I bond can come close to or beat the inflation rate. These bonds are 30-year instruments whose interest rate is reset every six months. The rate is a combination of an inflation calculation over a six-month timeframe and a fixed rate determined by the U.S. Treasury Secretary.

When combined, I bonds bought in April will be paid a full year interest rate of 8.54%, which is exactly what the CPI rate has been for the past 12 months. While this only keeps pace with the March inflation reading, if inflation decreases the I bonds return will be higher than inflation. One aspect about I bonds to keep in mind is that if they are redeemed within five years of being bought there is a three-month interest penalty, applied to the last three months of interest. If bonds are bought in April and redeemed after one year the penalty would result in an effective rate of 6.05%. Still much better than any other fixed income investment with such low risk.The Wall Street Journal published an article titled “.

While investors who buy in May will receive the 9.62% rate from May to November, the big unknown is what rates will be when it comes time for the rate to reset. With many economists believing March will be the peak in inflation and most are projecting that rates should decline, betting on a rate that will be as high as the current 7.12% over April to September this year for the next six month rate reset looks like a losing proposition.

The graph below is from Andrew Hunter, Capital Economics Chief Economist, which projects the headline inflation rate peaked in March and falls off substantially the rest of this year. If his forecast is anywhere close to correct the November 1 I bond interest rate will be substantially below 7.12%.Check out TreasuryDirect.gov for more infoThis site

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Here's what could trigger another risk-on, risk-on bout for stocks and bondsOur call of the day from Evercore is looking at the phenomenon of bonds and equities moving together. And a move up could be coming.

Here's what could trigger another risk-on, risk-on bout for stocks and bondsOur call of the day from Evercore is looking at the phenomenon of bonds and equities moving together. And a move up could be coming.

Read more »

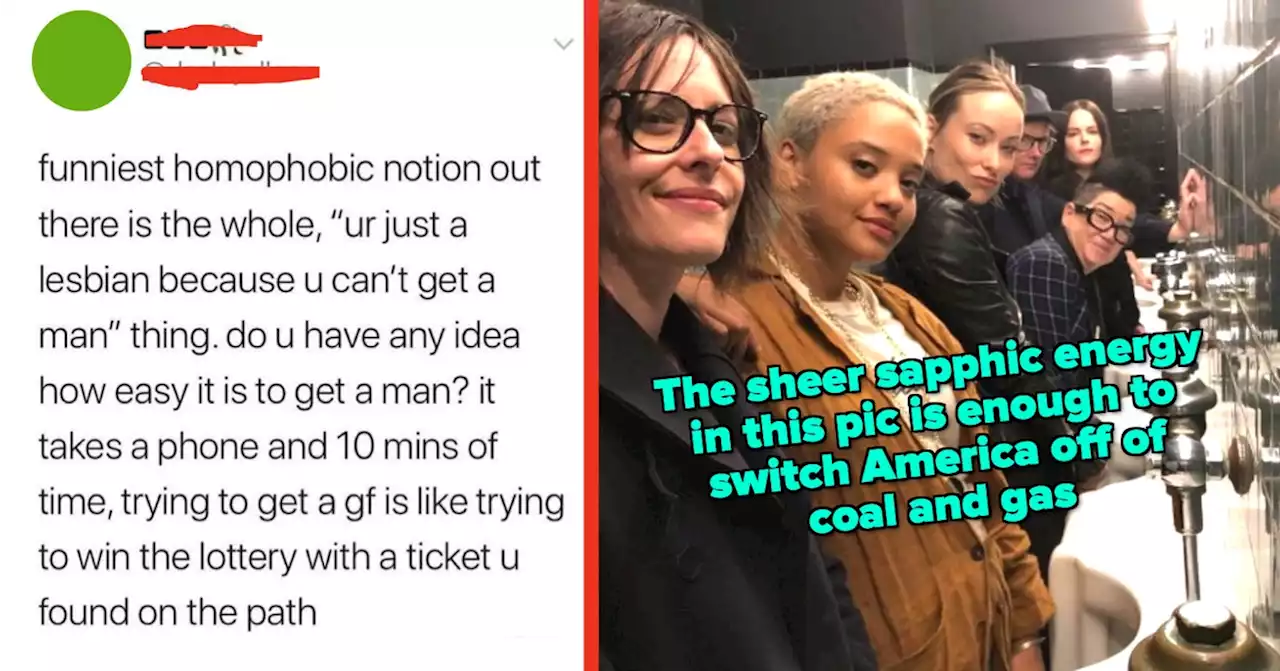

54 Times Queer Women Were The Funniest People On The Internet — Sorry, Straights (But Also Not Sorry)We need a three-hour lesbian film starring Rachel Weisz and Kathryn Hahn, and we need it now!

54 Times Queer Women Were The Funniest People On The Internet — Sorry, Straights (But Also Not Sorry)We need a three-hour lesbian film starring Rachel Weisz and Kathryn Hahn, and we need it now!

Read more »

Financial Face-Off: Should you use your tax refund to buy I bonds or crypto? One of these options could get a 9.6% return. Let us explain.A debate for Tax Day.

Financial Face-Off: Should you use your tax refund to buy I bonds or crypto? One of these options could get a 9.6% return. Let us explain.A debate for Tax Day.

Read more »

Here's what could trigger another risk-on, risk-on bout for stocks and bondsOur call of the day from Evercore is looking at the phenomenon of bonds and equities moving together. And a move up could be coming.

Here's what could trigger another risk-on, risk-on bout for stocks and bondsOur call of the day from Evercore is looking at the phenomenon of bonds and equities moving together. And a move up could be coming.

Read more »

Teachers in closets, desks in hallways: How Hays CISD is grappling with population boomDistrict voters can expect bond elections for years to come in order to build enough...

Teachers in closets, desks in hallways: How Hays CISD is grappling with population boomDistrict voters can expect bond elections for years to come in order to build enough...

Read more »