The failure to quell it quickly will transform financial markets

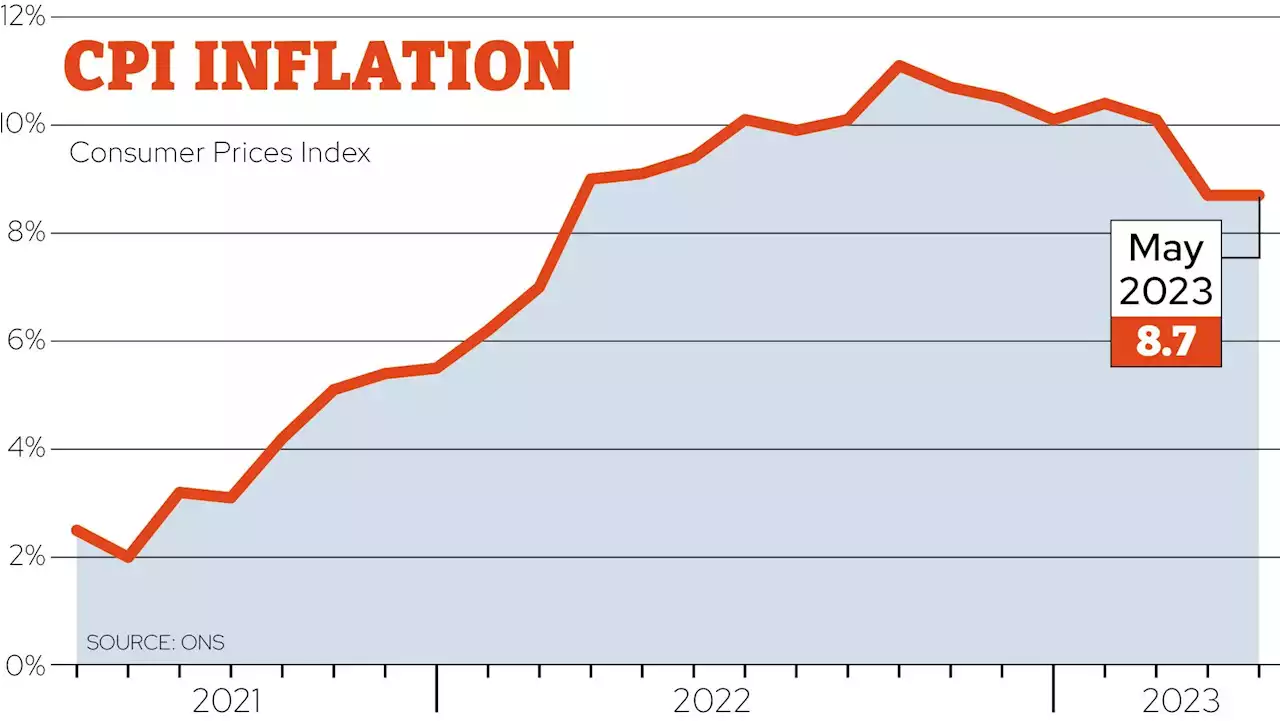

than two years since high inflation returned to the rich world, and hopes that it will quietly fade are themselves fading. True, prices are rising more slowly than in 2022, when the pace hit 9.1% in America, 10.6% in the euro area and 10.4% globally. But the view that this was just a passing lurch looks ever less plausible. Britain’s rate has been stuck at 8.7% for two months. American “core” prices, which exclude volatile food and energy, are 5.

The likelihood of monetary guardians explicitly admitting that they will tolerate inflation above 2% is low. Every time Jerome Powell, the chairman of the Federal Reserve, is asked about the possibility, he vehemently denies it. Such a shift, especially with prices already rising much faster than 2%, would immediately damage the Fed’s credibility: if the target can be ignored once, why not again?

But the erosion of the value of both the principal and the fixed interest payments is not the only way that higher inflation affects investments in bonds. Rising prices fuel expectations that central banks will raise rates, which in turn pushes yields in the bond market up to match those expectations. Bond prices are an inverse function of yields: when yields rise, prices fall.

On the face of things, shares are ideally suited to weathering spells of high inflation. They derive their value from the underlying companies’ earnings, and if prices are rising across the economy then those earnings, in aggregate, ought to be rising as well. Suppose inflation stays elevated but stable and the economy is otherwise humming along, says Ed Cole of Man Group, an asset manager. Managers should be able to control costs and adjust prices in response.

Moreover, during individual periods of high inflation, the historical record is less comforting for shareholders. Between 1900 and 2022, in years in which inflation rose above around 7.5%, the average real return on equities flipped from positive to negative. Even when inflation was lower than this, it tended to reduce the real returns from shares. In other words, though stocks tend to outpace inflation in the long term, in the short term they do not offer a true hedge against it.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Inflation latest updates: Experts wrong again as inflation unexpectedly remains same at 8.7%'If there was any doubt that the Bank of England would have to raise interest rates again on Thursday, this has ended it.' Sky's gurpreetnarwan has more on news that the rate of inflation has remained at 8.7% according to official figures. 📺 Sky 501

Inflation latest updates: Experts wrong again as inflation unexpectedly remains same at 8.7%'If there was any doubt that the Bank of England would have to raise interest rates again on Thursday, this has ended it.' Sky's gurpreetnarwan has more on news that the rate of inflation has remained at 8.7% according to official figures. 📺 Sky 501

Read more »

Pressure on Bank of England to hike interest rates to 5% despite expected dip in inflation📈 The Bank of England is under pressure to raise interest rates by as much 0.5% to 5 per cent this week in a fresh headache for Rishi Sunak as he faces a political backlash over the spike in mortgage costs

Pressure on Bank of England to hike interest rates to 5% despite expected dip in inflation📈 The Bank of England is under pressure to raise interest rates by as much 0.5% to 5 per cent this week in a fresh headache for Rishi Sunak as he faces a political backlash over the spike in mortgage costs

Read more »

UK grocery inflation eases for third month, Kantar data shows\n\t\t\tKeep abreast of significant corporate, financial and political developments around the world.\n\t\t\tStay informed and spot emerging risks and opportunities with independent global reporting, expert\n\t\t\tcommentary and analysis you can trust.\n\t\t

Read more »

Grocery inflation eases to 'slowest monthly rate this year'The third consecutive monthly easing in grocery inflation is welcome but no cause for celebration as the rate remains the sixth highest recorded in the past 15 years.

Grocery inflation eases to 'slowest monthly rate this year'The third consecutive monthly easing in grocery inflation is welcome but no cause for celebration as the rate remains the sixth highest recorded in the past 15 years.

Read more »

UK inflation rate remains unchanged at 8.7% in May – what it means for youTHE UK’s rate of inflation remained the same in May from the month before, the latest official figures show. The Consumer Price Index level of inflation was frozen at 8.7%, the same as in Apr…

UK inflation rate remains unchanged at 8.7% in May – what it means for youTHE UK’s rate of inflation remained the same in May from the month before, the latest official figures show. The Consumer Price Index level of inflation was frozen at 8.7%, the same as in Apr…

Read more »

Inflation remains at 8.7% - here's what it means for your moneyUK inflation has remained 8.7 per cent, which means the costs of goods are still increasing at the same rate as they were in April luciemheath explains what it means for your money

Inflation remains at 8.7% - here's what it means for your moneyUK inflation has remained 8.7 per cent, which means the costs of goods are still increasing at the same rate as they were in April luciemheath explains what it means for your money

Read more »