Resetting the official target is beside the point when the major issue for the central bank review should be making its policy processes more transparent.

of the Reserve Bank of Australia after the election. What should that review examine?

A major factor was that monetary policy targeted financial stability, often called “leaning against the wind”. The RBA claimed that low-interest rates would increase indebtedness and this would make household spending volatile. And this is not an isolated example. The RBA has a track record of analytical error compounded by resistance to review.recently pointed out the Reserve Bank’s culture of indolence. It has repeatedly responded too slowly and weakly to emerging problems.

At present, decisions are by “consensus”. This is undoubtedly comfortable for the governor, who has his decisions rubber-stamped. However, consensus stifles innovation. It promotes groupthink, insularity and status quo bias – leading complaints about the RBA.The Bank would make fewer and less persistent mistakes if it was more transparent. The country’s wisdom on monetary policy is not confined to Martin Place.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

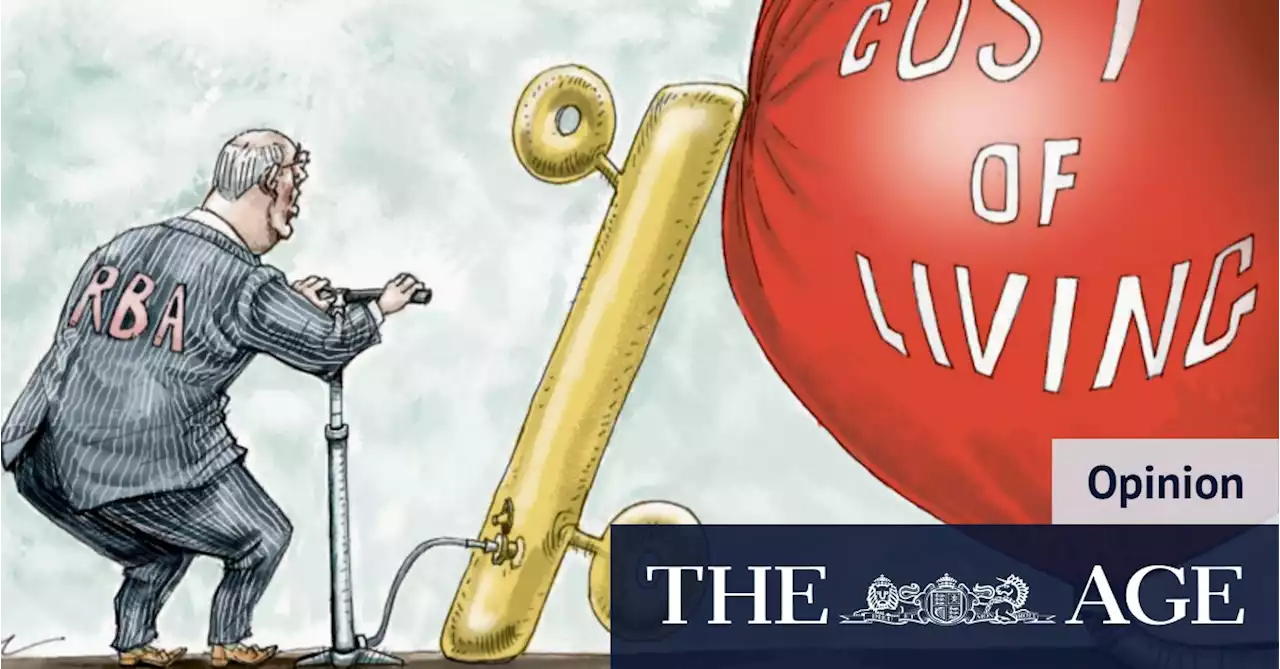

The cost of living is soaring, but higher interest rates won’t helpIf the Reserve Bank raises interest rates on Tuesday it will add to the cost pressures facing many consumers and become political dynamite. | OPINION by Ross Gittins

The cost of living is soaring, but higher interest rates won’t helpIf the Reserve Bank raises interest rates on Tuesday it will add to the cost pressures facing many consumers and become political dynamite. | OPINION by Ross Gittins

Read more »

ANZ, NAB to face pressures reporting after RBA’s rates decisionIf the Reserve Bank lifts the cash rate on Tuesday, ANZ and NAB chiefs will be in the spotlight as they explain defending profits while lifting customers’ costs.

ANZ, NAB to face pressures reporting after RBA’s rates decisionIf the Reserve Bank lifts the cash rate on Tuesday, ANZ and NAB chiefs will be in the spotlight as they explain defending profits while lifting customers’ costs.

Read more »

RBA to signal multiple interest rate risesThe Reserve Bank Governor Philip Lowe will make the announcement on Tuesday, regardless of whether it increases the 0.1 per cent cash rate in May or June.

RBA to signal multiple interest rate risesThe Reserve Bank Governor Philip Lowe will make the announcement on Tuesday, regardless of whether it increases the 0.1 per cent cash rate in May or June.

Read more »

Interest rates could be a game-changer in Sydney's property market | 7NEWSWith the Reserve Bank under pressure to raise interest rates, any decision is set to be a game-changer in Sydney's property market. It could offer a rare opportunity for first home buyers to crack the market. sydre 7NEWS

Interest rates could be a game-changer in Sydney's property market | 7NEWSWith the Reserve Bank under pressure to raise interest rates, any decision is set to be a game-changer in Sydney's property market. It could offer a rare opportunity for first home buyers to crack the market. sydre 7NEWS

Read more »

Property prices may tumble 15 per cent after rate increasesAnalysts at three of the big four banks are now forecasting the Reserve Bank will lift official interest rates for the first time in more than a decade on Tuesday

Property prices may tumble 15 per cent after rate increasesAnalysts at three of the big four banks are now forecasting the Reserve Bank will lift official interest rates for the first time in more than a decade on Tuesday

Read more »

US stocks plunge amid inflation concernsUS stocks have plunged as inflation concerns and declining Amazon earnings continue to weigh down markets.

US stocks plunge amid inflation concernsUS stocks have plunged as inflation concerns and declining Amazon earnings continue to weigh down markets.

Read more »