Homeowners are squirrelling away billions in offset accounts, but many aren’t using them to their full potential and are missing out on significant home loan savings.

Money editor Dominic Powell and our experts share tips on how to save, invest and make the most of your money., a free weekly newsletter giving expert tips on how to save, invest and make the most of your money, is sent every Sunday. You’re reading an excerpt −For those who are lucky/privileged enough to have one, there’s a lot to like about owning your own home. Having a roof over your head is pretty cool, and being part of the Australian property market is ... fine, I guess.

To start, an offset account is a transaction account that’s linked to your home loan. Any money you keep in that account is offset against your mortgage, reducing the amount of interest you pay, and you can access all the money in your offset account whenever you want, without restriction.in offsets as of December last year in an effort to buffer against potential future rate rises.

One of the simplest and most effective ways to make your offset account work harder is to organise with your workplace to have your salary paid directly into the account. This both maximises the amount you have in your offset does not rely on you moving the money across yourself. As interest on offset accounts is calculated daily, delaying or forgetting to transfer your funds can have an impact.

Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. They should always seek their own professional advice that takes into account their own personal circumstances before making any financial decisions.

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

'We still have an unliveable house': Insurance pain for homeowners years after floodsInfuriating stories of disputes with insurers have emerged at an inquiry into the response to south-east Queensland&x27;s February 2022 floods.

'We still have an unliveable house': Insurance pain for homeowners years after floodsInfuriating stories of disputes with insurers have emerged at an inquiry into the response to south-east Queensland&x27;s February 2022 floods.

Read more »

Major issue with common house featureAustralian homeowners are wasting hundreds of dollars on energy bills because of one simple design flaw.

Major issue with common house featureAustralian homeowners are wasting hundreds of dollars on energy bills because of one simple design flaw.

Read more »

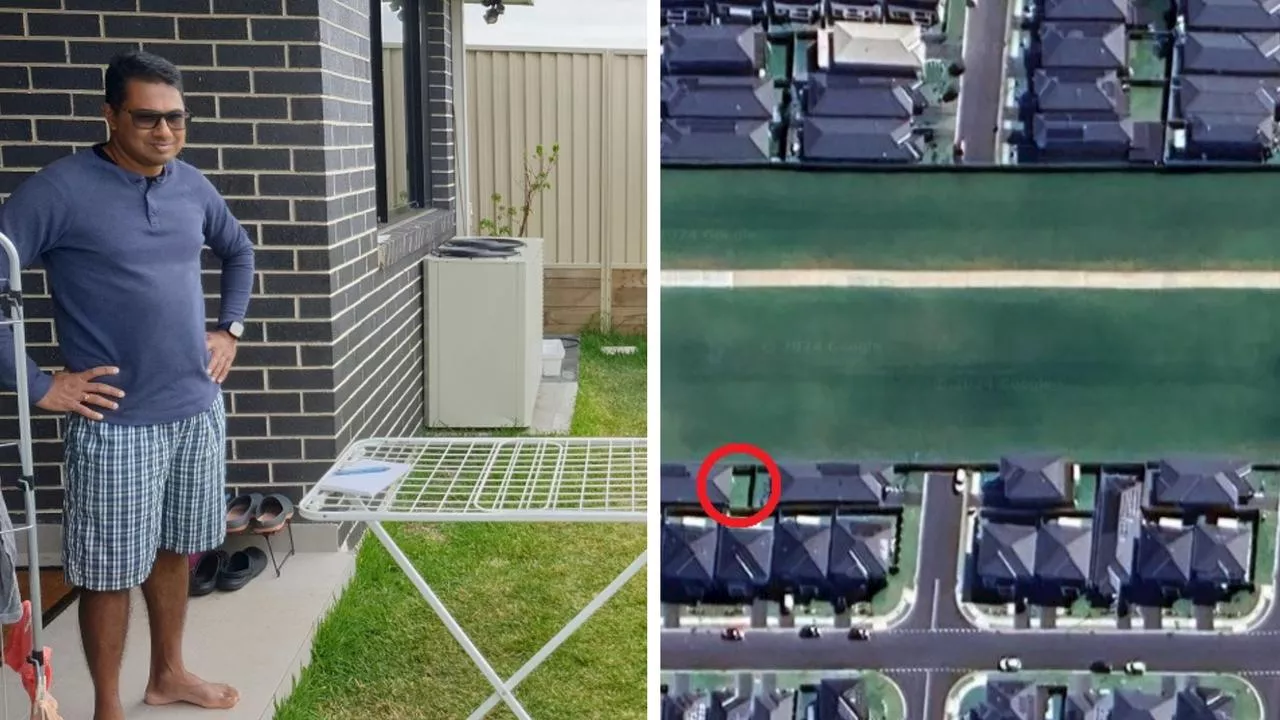

‘No complaints’: Cramped homeowners hit outEXCLUSIVE

‘No complaints’: Cramped homeowners hit outEXCLUSIVE

Read more »

Aussies unluckiest homeowners in the worldThe UN’s financial agency has confirmed what long-suffering Australian homeowners have been feeling over months of steep rate rises.

Aussies unluckiest homeowners in the worldThe UN’s financial agency has confirmed what long-suffering Australian homeowners have been feeling over months of steep rate rises.

Read more »

So you’ve got an offset account, but are you using it wisely?Homeowners are squirrelling away billions in offset accounts, but many aren’t using them to their full potential and are missing out on significant home loan savings.

So you’ve got an offset account, but are you using it wisely?Homeowners are squirrelling away billions in offset accounts, but many aren’t using them to their full potential and are missing out on significant home loan savings.

Read more »

JBH ASX: The ‘wealth effect’ where rising house prices generally spill over to spending in certain retailers such as JB Hi-Fi and Bunnings, has been tracked by broker Jarden for 20 years.Jarden highlights its best bets, saying homeowners feeling good about their property appreciation turn to spending more on big-ticket retail items.

JBH ASX: The ‘wealth effect’ where rising house prices generally spill over to spending in certain retailers such as JB Hi-Fi and Bunnings, has been tracked by broker Jarden for 20 years.Jarden highlights its best bets, saying homeowners feeling good about their property appreciation turn to spending more on big-ticket retail items.

Read more »