This article explores the reasons why some large companies in Australia seem to avoid paying significant income tax, despite generating substantial profits. It delves into the complexities of tax law, multinational tax planning strategies, and the Australian imputation system. The article also highlights recent tax reforms aimed at addressing this issue.

I make what I believe is a little above the median salary in Australia. I pay $12,000 in income tax, give or take. I have no problem with this, as I like that my money goes to hospitals, roads and schools. But I do not understand why I pay amounts like this year after year while companies making billions of dollars often pay nothing in tax.

I know there is some kind of accounting trick involved, so I half understand a single year of paying no tax, but how does it happen over five or ten years? Isn’t this unfair? Why do we let this happen? The list of ways companies can avoid paying tax is as long as your arm, but there are a few simple explanations for this harrowing quandary. I asked Dale Boccabella, who’s an associate professor of taxation law in the school of accounting at the University of NSW about your concern. He said your question gets asked by many people, especially around the time the Australian Taxation Office (ATO) releases its annual report of entity tax information. Associate Professor Boccabella said “fact situations” were the circumstances that went some way to determining how a company might be taxed. They include things such as whether an organisation is Australian or foreign, is part of a consolidated group, is a holding company, has significant tax losses from previous years and so on. The professor explained that taxable profits – taxable income – are shifted to low company tax countries, and away from high company tax countries. “The question is clearly focused on income tax – sometimes called company tax. It is worth noting that some companies that may not have any income tax liability for a year may be paying some of Australia’s other taxes over the same period. For example, GST, fringe benefits tax, state payroll or land taxes, local government rates and royalty taxes on mining.” Associate Professor Boccabella said that it may be obvious, but it bears repeating that income tax is paid on taxable income, not on turnover or accounting profit. “The rules for measurement of accounting profit are different to the rules for measurement of taxable income. Hence, when finance journalists state that a company made profits of, say, $50 million for a year and paid no income tax, the statement is misleading. It is misleading because it implies tax is paid on accounting profit.” “One might suggest that we change the tax rules so that tax is paid on accounting profit - because this is often higher. This is not a good idea because accounting profit under the accounting standards can involve considerable judgment, and company directors are very likely to use that judgment to reduce accounting profits when it suits.” The above goes for all companies, but another problem that Associate Professor Boccabella identified relates mostly to multinational companies, particularly their attempts to minimise their worldwide tax bill. “This usually means having taxable profits – taxable income – shifted to low company tax countries, and away from high company tax countries. Australia’s 30 per cent company tax rate is higher than the company tax rate in many other countries.” They can do this in numerous different ways, and will often be “very aggressive and strategic in their tax planning”, Associate Professor Boccabella said. He also said that allowing tax losses of a previous year to be deductible against taxable income in a future year is a “principled tax position”. However, there is no doubt “the ATO is wary where any taxpayer claims they have substantial tax losses from an earlier year. At times, these claims can turn out to be baseless”. But there is what Associate Professor Boccabella describes as an interesting twist or counter-phenomenon that is worth knowing about. It relates to Australia’s imputation system. “Franking credits are highly valued by potential investors and because of this, there may be an incentive for Australian companies to pay tax in Australia so that they have franking credits to pass on to their shareholders. This provides a contradictory pull factor.” As to your question about why we’re letting this happen, Associate Professor Boccabella said that, in fact, “there have been many recent reforms to tax rules in Australia to build more integrity” into the system. However, it’s “likely it could take some time before these rules have full effect in helping to ensure that Australia obtains its fair share of tax revenue from foreign multinationals”

TAXATION AUSTRALIA CORPORATE TAX MULTINATIONAL COMPANIES TAX AVOIDANCE INCOME TAX AUSTRALIAN TAXATION OFFICE ACCOUNTING PROFIT TAX REFORMS

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Tennis Australia's Big Salaries Spark DebateThis news article discusses the high salaries paid to tennis figures like Mark Woodbridge and Lleyton Hewitt by Tennis Australia. It compares their earnings to those of other public servants and highlights concerns about the disparity between executive pay and prize money growth.

Tennis Australia's Big Salaries Spark DebateThis news article discusses the high salaries paid to tennis figures like Mark Woodbridge and Lleyton Hewitt by Tennis Australia. It compares their earnings to those of other public servants and highlights concerns about the disparity between executive pay and prize money growth.

Read more »

The 18 things (not necessarily big) that made Australia what it is todayFrom a giant ram to Ned Kelly’s armour, these key treasures perfectly capture our pop culture, history and achievements as a nation.

The 18 things (not necessarily big) that made Australia what it is todayFrom a giant ram to Ned Kelly’s armour, these key treasures perfectly capture our pop culture, history and achievements as a nation.

Read more »

Don’t celebrate Australia Day, it’s the Australian wayAge readers respond to the politics surrounding Australia Day.

Don’t celebrate Australia Day, it’s the Australian wayAge readers respond to the politics surrounding Australia Day.

Read more »

Australia's Big Four Banks Predict RBA Rate Cut in FebruaryAustralia's major banks are anticipating a reduction in the official cash rate by the Reserve Bank of Australia (RBA) at its upcoming February meeting. Weaker-than-expected inflation figures and a softening housing market are driving the predictions.

Australia's Big Four Banks Predict RBA Rate Cut in FebruaryAustralia's major banks are anticipating a reduction in the official cash rate by the Reserve Bank of Australia (RBA) at its upcoming February meeting. Weaker-than-expected inflation figures and a softening housing market are driving the predictions.

Read more »

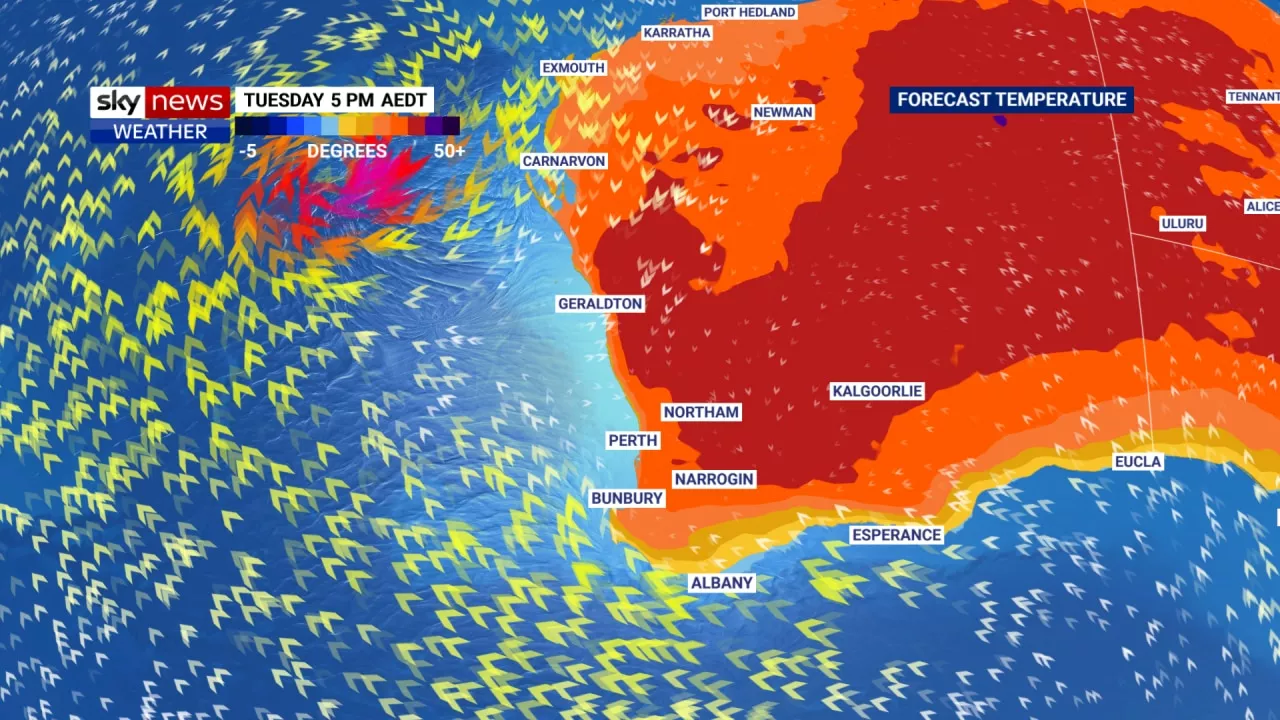

Australia Faces Devastating Heatwave: Record Temperatures Scorch Western Australia, Queensland to FollowRecord-breaking temperatures are plaguing Western Australia, while Queensland prepares for a dangerous heatwave. Perth and Geraldton experience scorching highs, with the former hitting its hottest day in a decade. The BOM warns residents to take precautions against the extreme heat, which can be especially dangerous for vulnerable groups.

Australia Faces Devastating Heatwave: Record Temperatures Scorch Western Australia, Queensland to FollowRecord-breaking temperatures are plaguing Western Australia, while Queensland prepares for a dangerous heatwave. Perth and Geraldton experience scorching highs, with the former hitting its hottest day in a decade. The BOM warns residents to take precautions against the extreme heat, which can be especially dangerous for vulnerable groups.

Read more »

Double Demerit Periods Across Australia During Australia Day Long WeekendThis article outlines the double demerit point periods in effect across Australia during the Australia Day long weekend. It details the specific jurisdictions affected, the duration of the double demerit period, and the offenses that trigger these enhanced penalties. The article also clarifies how double demerits apply to drivers with licenses from different states and territories.

Double Demerit Periods Across Australia During Australia Day Long WeekendThis article outlines the double demerit point periods in effect across Australia during the Australia Day long weekend. It details the specific jurisdictions affected, the duration of the double demerit period, and the offenses that trigger these enhanced penalties. The article also clarifies how double demerits apply to drivers with licenses from different states and territories.

Read more »