It's a matter of when, not if, the Reserve Bank will take the knife to interest rates, but first home buyers may only see a fleeting, and possibly minuscule, improvement in affordability.

It could be as early as next month and won't be any later than early in the New Year.If you are a first home buyer, it most likely will be a fleeting, and possibly minuscule, improvement.

Exactly when the Reserve Bank of Australia pulls the lever on rate cuts will depend on the data released over the next few weeks. Unfortunately, that could be enough to lure in more buyers, which will push prices higher and smash any hopes first home buyers may have — unless, of course, they have parents willing to stump up an early inheritance.When it comes to housing affordability, many merely consider the price of a dwelling.

Then came the pandemic, with an official cash rate of just 0.1 per cent, which lifted affordability levels back to where they were at the turn of the century.Photo shows Crowd of people on the streets of Sydney But since the beginning of last year, against all logic, they surged again, primarily because population growth began to outstrip housing supply.

For those aged more than 70, the proportion of Australians owning a home now is roughly the same as that in 1981.

Reserve Bank Of Australia Housing Affordability First-Home Buyers

Australia Latest News, Australia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

RBA interest rates: Reserve Bank reforms dead after Labor ends negotiations with GreensTreasurer Jim Chalmers’ plan to create a specialist monetary policy board at the Reserve Bank is dead after the government ruled out working with the Greens.

RBA interest rates: Reserve Bank reforms dead after Labor ends negotiations with GreensTreasurer Jim Chalmers’ plan to create a specialist monetary policy board at the Reserve Bank is dead after the government ruled out working with the Greens.

Read more »

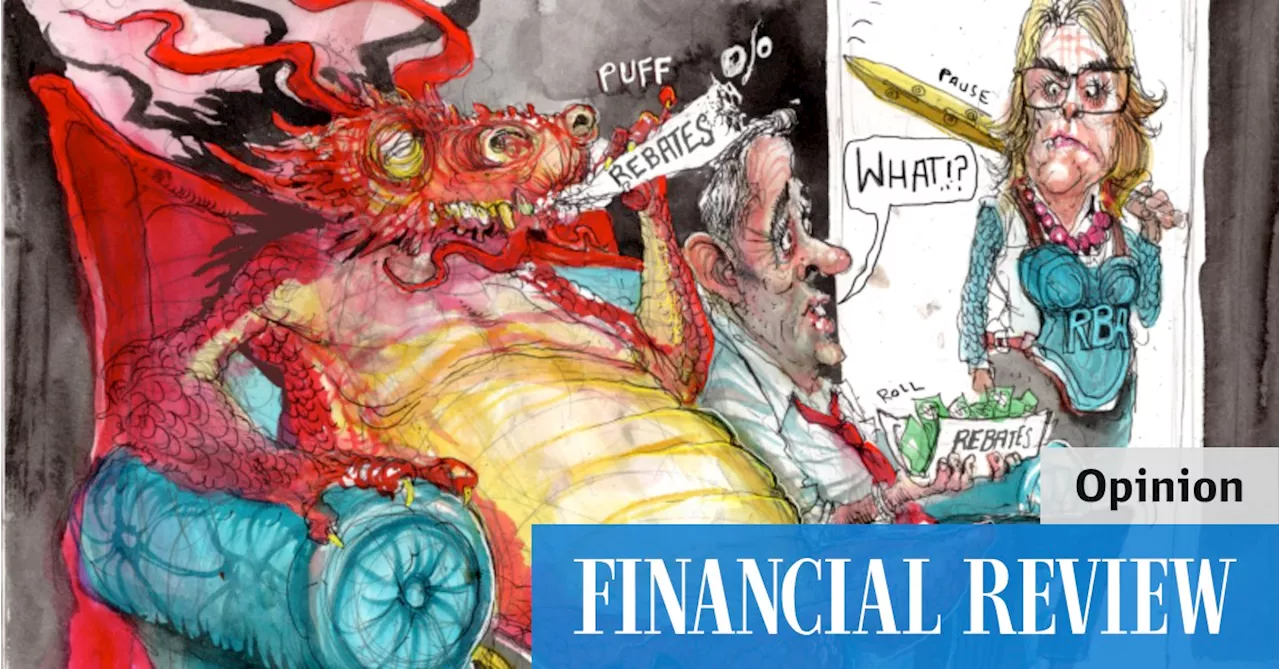

RBA: Political perception is why Treasurer Jim Chalmers is hammering the Reserve Bank of AustraliaThe treasurer’s attack on the central bank signals a new era where politicians will target entities deemed to be hurting ordinary Australians.

RBA: Political perception is why Treasurer Jim Chalmers is hammering the Reserve Bank of AustraliaThe treasurer’s attack on the central bank signals a new era where politicians will target entities deemed to be hurting ordinary Australians.

Read more »

RBA interest rates: Jobs data and big-spending governments mean the Reserve Bank of Australia can’t follow the US Federal ReserveThe labour market is softening only at a glacial pace, thanks in no small part to strong public sector jobs growth. That leaves the RBA in a bind.

RBA interest rates: Jobs data and big-spending governments mean the Reserve Bank of Australia can’t follow the US Federal ReserveThe labour market is softening only at a glacial pace, thanks in no small part to strong public sector jobs growth. That leaves the RBA in a bind.

Read more »

Interest rates: Bank of England holds interest rates after Federal Reserve cutsFacing less pressure from its economy or jobs market, the BoE is expected to wait until November to unleash a second interest rate cut.

Interest rates: Bank of England holds interest rates after Federal Reserve cutsFacing less pressure from its economy or jobs market, the BoE is expected to wait until November to unleash a second interest rate cut.

Read more »

Reserve Bank tipped to keep interest rates on hold todayMortgage holders are likely again to be denied any relief today when the central bank announces its cash rate decision.

Reserve Bank tipped to keep interest rates on hold todayMortgage holders are likely again to be denied any relief today when the central bank announces its cash rate decision.

Read more »

Reserve Bank keeps interest rates on hold at 4.35pcThe RBA has kept interest rates on hold at 4.35 per cent, saying inflation is still too high to start cutting rates.

Reserve Bank keeps interest rates on hold at 4.35pcThe RBA has kept interest rates on hold at 4.35 per cent, saying inflation is still too high to start cutting rates.

Read more »